Sign in or join

Add a note by highlighting text or Replying to an existing note.

Add a note by highlighting text or Replying to an existing note.

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2003

Commission File Number 0-28018

YAHOO! INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 77-0398689 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

701 First Avenue

Sunnyvale, California 94089

(Address of principal executive offices)

Registrant's telephone number, including area code: (408) 349-3300

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

(Title of Class)

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes /x/ No / /

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. /x/

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes /x/ No / /

As of June 30, 2003, the aggregate market value of voting stock held by non-affiliates of the Registrant, based upon the closing sales price for the Registrant's Common Stock, as reported in the NASDAQ National Market System, was $15,444,607,992. Shares of Common Stock held by each officer and director and by each person who owns five percent or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

The number of shares of the Registrant's Common Stock outstanding as of February 25, 2004 was 665,159,934.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K:

OVERVIEW

Yahoo! Inc., together with its consolidated subsidiaries, ("Yahoo!", "Our" or "We") is a leading provider of comprehensive Internet products and services to consumers and businesses through our worldwide network of online properties (the "Yahoo! network"). Yahoo! was developed and first made available in 1994 by our founders, David Filo and Jerry Yang, while they were graduate students at Stanford University. Yahoo! was incorporated in 1995 and is a Delaware corporation.

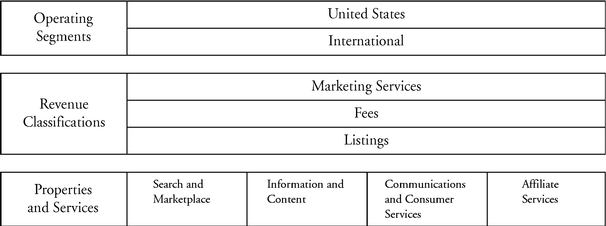

Headquartered in Sunnyvale, California, we have offices in North America, Europe, Asia, Latin America and Australia. We manage our business geographically; our principal areas of measurement and decision-making are the United States and International. Our properties and services for consumers and businesses currently reside in four areas: Search and Marketplace; Information and Content; Communications and Consumer Services; and Affiliate Services. Our basic products and service offerings are available without charge to our users. We also offer a variety of fee-based premium services that provide our users access to value-added content or services. In addition, we sell marketing and advertising services to businesses across the majority of our properties and services.

During 2003, we completed the acquisitions of Inktomi Corporation ("Inktomi") and Overture Services, Inc. ("Overture") in March and October, respectively. Inktomi is a provider of Web search and paid inclusion services on the Internet. Overture is a provider of commercial search services on the Internet, including pay-for-performance search services. Since inception, we have acquired several other companies including those that provided databases, software, technologies, content, and/or tools to develop and expand upon our network of properties and services.

We generate multiple sources of revenue across these properties and services that are classified as: Marketing Services, Fees and Listings. The following table presents an overview of our financial reporting structure as well as our properties and services.

PROPERTIES AND SERVICES

Our properties and service offerings are generally available without charge to our users. We generate revenues from marketing and listing services, and also offer fee-based premium services that provide our users access to additional content or services.

Search and Marketplace

Our Search and Marketplace properties focus on being the starting point for consumers and businesses looking for information and looking to purchase products and services. The properties include the following:

2

Search

Yahoo! Search offers users a highly relevant, comprehensive, fast and easy-to-use search experience on the Internet. Our search properties are a gateway to the properties and services within the Yahoo! network. Using complex search engine algorithms, Yahoo! Search provides users with free Web-wide search results prioritized based on relevance. Our Yahoo! Search also offers a hierarchical, subject-based directory of Websites. Users can access directory listings by browsing through subject matter or using the keyword search function.

We generate revenue primarily by providing enhanced placement of our customers' Websites in our search results. Additionally, we generate revenue through our paid inclusion service, which guarantees that our customers' Websites are included in the Web search index, and through fees generated from customers who use our Web search services and incorporate the search results we provide into their online offerings to end users. See "Affiliate Services" below for further explanation.

Local

Yahoo! Local is comprised of four comprehensive offerings of local information, available free to users Yahoo! Yellow Pages, Yahoo! Maps, Yahoo! City Guides, and Yahoo! Real Estate. Yahoo! Yellow Pages enables users to connect to local and national merchants in the United States. Yahoo! Yellow Page business listings can be displayed by proximity to the user's location. Businesses can pay to have their listings placed in the Sponsored Business section above regular non-paid listings. Yahoo! Maps provides interactive maps with zooming and other capabilities and integrated driving directions. Yahoo! City Guides offers information on local arts and entertainment news and events. Yahoo! Real Estate offers free services to our users including: information for prospective home buyers and sellers; the ability to search for listed properties based on geography, price and features; moving-related content and services; information about finding a real estate agent, researching neighborhoods, financing and insurance, and home improvement ideas; and assistance in locating rentals and roommates. Users can also pay to list a property.

Autos

Yahoo! Autos offers information about buying, selling, leasing and owning automobiles. Services available free to our users include new and used car searches; pricing, specification, insurance, general financing, and other research information; and new car quote referral services provided through third parties.

Shopping/Auctions

The Yahoo! Shopping platform provides, free of charge to users, search functionality and comparison-shopping tools making it easy for consumers to find, research, compare and conveniently buy almost anything online including consumer electronics, apparel, books and flowers. Yahoo! Shopping combines comprehensive product search functionality with a full suite of comparison shopping, merchant rating and product review tools. Yahoo! Shopping connects buyers and sellers, and is a starting point for online commerce.

Yahoo! Auctions creates a marketplace for buyers and both individual and corporate sellers who wish to purchase or sell goods in an auction-style setting. Yahoo! Auctions connects buyers and sellers, generating revenue through listing fees and revenue share of the final selling value from sellers, and is available free of charge to buyers.

Travel

Yahoo! Travel provides research and booking functionality for consumers to find, compare and conveniently buy leisure travel products such as flights, hotel rooms, vacation packages and cruises. Yahoo! Travel generates revenue through transactions fees and advertising from travel suppliers and advertisers.

3

Careers

Our Yahoo! HotJobs ("HotJobs") property is a leader in the online recruiting industry, providing comprehensive solutions for employers, staffing firms and job seekers. HotJobs' tools and advice put job seekers in control of their career search and make it easier and more cost-effective for recruiters and employers to find qualified candidates compared to offline alternatives. We provide services for job seekers, which include the ability to create a resume and to search and apply for jobs, as well as access to newsletters, online forums and salary research, free of charge. We generate revenues from employers and staffing firms that access our database of job seekers and use our tools to post, track and manage job openings. In addition to our popular consumer job board, HotJobs provides employers and staffing agencies with a variety of recruiting solutions, including hiring management software.

Small Business

Yahoo! Small Business provides a comprehensive suite of fee-based services that enable a company to develop an online presence (through Yahoo! Domains, Yahoo! Business Mail and Yahoo! Web Hosting), sell their products online (through Yahoo! Merchant Solutions) and market online by integrating offerings such as Yahoo! Shopping, pay-for-performance search and Yahoo! Yellow Pages.

Information and Content

Our Information and Content properties deliver information and entertainment to consumers. We offer basic content that is available without charge to our users, and also provide some of our content on a fee or subscription basis. Our properties provide information and content including the following:

Media

Yahoo! Sports provides up-to-the-minute news, real-time statistics and scoring, broadcast programming, localized and global coverage, integrated shopping and auctions opportunities, and an on-line sports community. Yahoo! Sports has content or marketing relationships with professional sports organizations including the National Basketball Association and the Major League Baseball Players Association, among others, as well as sports media outlets such as Sports Illustrated Interactive. Yahoo! Sports also offers fee-based fantasy games' sports statistic trackers and leagues and audio feeds.

LAUNCH, Music on Yahoo! is a comprehensive online music destination. LAUNCH provides music fans with access to a wide selection of streaming audio, music videos, artist interviews, music news, album reviews and artist biographies. In 2003, LAUNCH introduced a variety of fee-based music services such as concert ticket offerings and premium radio.

Yahoo! Games offers free, Java-based classic board, card and word games along with downloadable games, game strategy guides, shopping guides, gaming news and reviews on computer and console videogames. Yahoo! Games also offers a variety of fee-based premium downloads and subscriptions.

Finance

Yahoo! Finance provides a comprehensive set of financial resources from investment and company information to personalized financial management tools. Yahoo! Finance offers Money Manager, a free set of financial tools that provides an integrated view of an individual's financial life. In addition, Yahoo! Finance offers fee-based products, including a real-time stock quotes package, research reports and services to allow users to pay their bills online.

Entertainment

Yahoo! Movies offers a daily mix of exclusive movie-related content, movie news and special features, including box office results, trailers, and photo galleries, as well as links to the movie-related content across the Yahoo! network. Yahoo! Movies features paid-for film promotions for major movie studios, including Disney, Sony, Warner Bros., Universal and Fox. Yahoo! TV connects users to personalized television listings and other television-related content.

4

Information

Yahoo! News aggregates news stories from news providers, bringing together content from media companies such as Associated Press, Reuters, AFP, The Washington Post, USA Today, Tribune Interactive, National Public Radio, US News & World Report, and more. Through Yahoo! News, users receive up-to-the-minute news coverage with text, photos, audio and video, from multiple sources and points of view.

Yahooligans! is an entertaining and educational Web guide targeted for children ages seven to twelve. Yahooligans! provides games, instant messaging, reference materials and movie information, among others.

Yahoo! Health is a comprehensive starting point for users to find healthcare information. Yahoo! Health provides information and links to sites on diseases, conditions and medications, as well as listings for various health information centers, clinical trial information and online community tools.

Network Services

The Yahoo! Front Page (www.yahoo.com) serves as a free navigation hub and entry point into the Yahoo! network. Among many available features on the page are the ability to perform a Web search, read the latest news, link to Yahoo! sites, and view promotions from Yahoo!'s key advertising partners.

My Yahoo! is our free, personalized Web information service that allows registered members to create a personal profile which organizes and delivers information of personal interest to the user via a user-customized interface. The My Yahoo! platform allows us to deliver targeted product, advertising and transaction-based services on behalf of our advertisers and partners.

Yahoo! Companion is a free browser add-on that enables users to conveniently access our properties and services from anywhere on the Web.

Communications and Consumer Services

Our Communications and Consumer Services group provides a wide range of communication and content services to consumers and small businesses. The offerings are distributed both on the Yahoo! network and through our access alliances, including those with SBC Communications Inc. ("SBC") and British Telecommunications plc. ("BT"). These offerings incorporate a suite of integrated Yahoo! tools and services including safety and security features, communications tools, compelling content, and a customized Internet browser all in an individualized environment.

Premium Internet Packages

During 2002, we launched a strategic alliance with SBC to offer a co-branded Internet service to DSL (broadband) customers in SBC's 13-state region and to dial-up subscribers nationwide. The services offer consumers integrated access and premium services on a subscription basis, and include a suite of Yahoo! and SBC customized products and services. During 2003, we launched a similar alliance with BT offering co-branded DSL, dial, and email services in the United Kingdom. In December of 2003, Yahoo! also introduced Yahoo! Plus, a comprehensive premium Internet package for users with broadband Internet access. In early 2004, Yahoo! announced an alliance with Rogers Cable Inc., which will provide broadband Internet access bundled with Yahoo! products and services in Canada.

Communications

Yahoo! Mail is a free service that provides users with a full-featured email experience including industry-leading Spam control, robust address book functionality and integration with Yahoo! Calendar. In addition to our basic email service, we offer premium Mail products that include extra email storage, mail forwarding and the ability to use Yahoo! Mail with other client applications. Yahoo! Mail Plus, a premium mail product, offers a combination of these features plus enhanced junk mail control, increased virus protection and personalized stationery.

Yahoo! Messenger provides a platform for instantaneous communications for personal and business users. Users can interact with friends and family on a real-time basis while

5

customizing the experience via features such as IMVironments which allows users to change the messaging window background, animated emoticons, video Web cams and integrated mobile messaging. For a fee, Yahoo!'s Enterprise Edition Messenger extends the benefits of this instant communication to the workplace by adding an enhanced level of security and centralized administrative control. This service was formerly part of our Enterprise Solutions business along with Yahoo! Portal Solutions and Broadcast Solutions, which provided communications solutions to help businesses more easily aggregate and distribute business critical information and interact with their target audience. During 2003 we reduced our Yahoo! Portal Solutions and Broadcast Solutions efforts and reorganized Enterprise Edition Messenger into the Communications and Consumer Services group.

Yahoo! Photos makes it easy for a user to upload and store pictures, as well as share them with friends and family for free. For example, Yahoo! users can now view their pictures with a friend instantly using a specially designed Yahoo! Photos IMVironment. Users can also order prints with the click of a mouse as a premium service.

Our online Communities help users build and manage relationships and includes properties such as Yahoo! Groups, Chat, Member Directory, and Message Boards. Yahoo! Groups gives users a convenient way to connect with others who share the same interests and ideas through a Website and email group.

Personals

Yahoo! Personals allows users to post a profile and search for others with whom to communicate for free. Users can also send short one-time messages to others in the community to communicate their interest without charge. With a subscription, Yahoo! Personals' users can email and use Yahoo! Messenger to communicate with others in the community. Our Personals service includes online dating industry-leading features such as voice and video clips, and a special recommendations engine called "Likely Likables," which uses advanced search technology to bring similar people together in the community.

Mobile

Through paid arrangements with leading wireless carriers around the world, Yahoo! Mobile makes a range of Yahoo! products and services available through wireless phones and PDA's. Customers can access a variety of Yahoo! services for free, including email, instant messaging, and a wide range of information offerings on their mobile phones via wireless-specific browsers. Yahoo! also allows consumers to receive mobile alerts on a wide variety of interests from sports scores to breaking news to weather. In 2003, Yahoo! launched a number of innovative mobile features including PC-to-SMS (Short Message Service) messaging and Yahoo! Mobile Photos.

Affiliate Services

We offer pay-for-performance advertising, paid inclusion and algorithmic search services. These services connect advertisers and potential buyers through our network and our affiliates' Websites, networks of Web properties that have integrated Overture's search service into their Web pages. These services include:

Pay-For-Performance

Precision Match or keyword search prioritizes search results by the amount the advertiser has bid for placement. Advertisers are listed in the search results on our network and also on our affiliates' networks in descending order of their bid, with the highest bidder appearing as the first search listing in the search results. Bids may be expressed either as the amount the advertiser pays each time there is a click on the advertiser's search listing or as the maximum amount the advertiser is willing to pay for a click on the advertiser's search listing. Advertisers pay only when a click-through occurs on the advertiser's search listing. Advertisers may see the bids of other advertisers on their keywords, enabling the advertiser to determine his or her own bid necessary to achieve a desired ranking, which instills competition among advertisers and promotes greater relevance for consumers. Most advertisers utilize self-service tools to open and manage accounts online including tracking, bid management and measurement features.

6

Content Match allows businesses to place listings on more locations on the Web and drive more traffic to their sites. Content Match displays listings when Internet users are viewing related content on the Yahoo! network or our affiliates' pages. For example, if the user is reading an article about interest rates, he or she could find links on the side of the page for mortgage-related advertisers. Similarly, users who are researching vacation plans may see listings for hotels and rental car agencies.

Paid Inclusion

Paid Inclusion guarantees that our customers' Websites are included and frequently updated in the index that is crawled by the search engine. Customers may pay fees based on sales leads or click-throughs powered by our search services. Customers may also pay a fixed fee that provides inclusion in the Web search index and an automatic 48-hour refresh of the submitted content. Through our paid inclusion programs, customers submit information often not normally available by traditional Web crawling techniques and this information is included in our Web search index.

Algorithmic Search

Our Algorithmic Search services provide search results to some of our affiliates, who in turn incorporate these results into their online offerings to end users. Our search engine uses proprietary technology to crawl the Web, index and serve Web results on text-based queries. Customers pay per-query search fees based on query volume.

GEOGRAPHIC PROPERTIES

We seek to build upon our global user base by developing Internet properties and services focused on geographic regions, which include foreign countries as well as domestic metropolitan areas. We have launched numerous geographically targeted Web properties and search services. Additional information required by this item is incorporated herein by reference to Note 12 "Segments" of the Notes to the Consolidated Financial Statements, which appears in Item 8 of this Annual Report on Form 10-K.

Yahoo! Inc. and its subsidiaries provide products and services in 13 languages in over 20 countries, including localized versions of Yahoo! in Argentina, Australia & New Zealand, Brazil, Canada, China, France, Germany, Hong Kong, India, Italy, Japan, Korea, Mexico, Singapore, Spain, Taiwan and the United Kingdom & Ireland. We also provide services through Yahoo! Asia (our portal to southeast Asia), Yahoo! Chinese (U.S. Chinese language site), Yahoo! en Español (U.S. Hispanic site), Yahoo! Canada en Français (French Canadian) and Yahoo! en Català (part of Yahoo! Spain's Catalan language offerings). Outside the English-speaking markets, we have built independent directories of local language Websites and other content, developed by native speakers of each language. We own a majority or 100 percent of these non-U.S. operations (except in Japan), and have established offices internationally to facilitate the local development of these businesses. We have pursued a consistent strategy of content aggregation with leading third parties and currently plan to continue to rollout certain selected services for our international markets.

Our joint ventures with SOFTBANK and its affiliates, a holder of approximately four percent of our common stock as of December 31, 2003, include Yahoo! Germany, Yahoo! United Kingdom, Yahoo! France (collectively "Yahoo! Europe"), Yahoo! Japan and Yahoo! Korea. These joint ventures were formed to establish and manage local versions of our properties in the respective countries. With the exception of Yahoo! Japan, these joint ventures are operated and managed by us as a part of our global network. Yahoo! Japan is a publicly traded company in Japan that is majority owned by SOFTBANK. As of December 31, 2003, we owned approximately 70 percent of Yahoo! Europe, 34 percent of Yahoo! Japan and 67 percent of Yahoo! Korea. Yahoo! Europe and Yahoo! Korea are consolidated subsidiaries of Yahoo! Inc. The Company has no funding commitment to Yahoo! Japan. As of December 31, 2003, SOFTBANK and its affiliates owned the remaining interests in Yahoo! Europe and Yahoo! Korea not owned by Yahoo! and its affiliates.

REVENUE CLASSIFICATIONS

Marketing services revenue is primarily generated from the sale of rich media advertisements (banner and other media advertisements), sponsorship and text-link advertisements, (including pay-for-performance search advertisements), paid inclusion, algorithmic searches and transactions revenue. Banner and other media agreements typically consist of targeted and non-targeted advertising that appears on or around pages within the Yahoo! network. Sponsorship agreements take many forms including: high profile promotions that are typically focused on a particular event, such as a sweepstakes; third party branded content integration into our properties allowing marketers to provide information about their products to consumers; and

7

merchant sponsorship opportunities on targeted Yahoo! properties encouraging users to purchase the goods and services of our advertisers. Text-links and hypertext links are links that are embedded in certain words, advertisements, sponsorships or directed emails, which provide the user with instant access to the advertiser's Website, to obtain additional information or to purchase products and services. Additionally, we offer online research and data services, enabling marketers to better understand their customers profiles and behaviors. Transactions revenue includes service fees for facilitating transactions through the Yahoo! network.

Although a significant amount of advertising purchases on our properties are for general rotation on pages within the Yahoo! network, we also offer highly-targeted marketing opportunities that are designed to deliver greater value to advertisers through more focused audiences. By developing an extended family of Yahoo!-branded properties, we seek to offer advertisers a wide range of placement options and promotional opportunities. For example, through our pay-for-performance search advertisements, advertisers can bid for priority placement in search results. We also offer an integrated set of sales and marketing tools built on the Yahoo! network and delivered in an integrated manner to our global audience. They consist of innovative, interactive marketing programs designed to provide one-stop shopping for companies seeking to secure a measurable Internet presence.

We maintain three primary channels for selling our marketing services: online, telephone and direct. Our Sponsored Matches service, which provides enhanced visibility for Websites within Yahoo!'s search results, is primarily sold through our online and direct channels. Under this program, search results pages feature up to the top six pay-for-performance search listings sold to advertisers. Our telemarketing channel focuses on sales of online marketing services to small and medium-size businesses. Our direct advertising sales team focuses on selling our marketing services and solutions to leading agencies and marketers in the United States. As of December 31, 2003, we employed advertising sales professionals in 10 locations across the U.S., including: Atlanta, Boston, Chicago, Dallas, Detroit, the Los Angeles Area, Miami, New York, the San Francisco Bay Area and Washington D.C. Our advertising sales organization consults regularly with agencies and advertisers on design and placement of Web-based advertising, and provides clients with measurements and analyses of advertising effectiveness. In addition to our geographic sales structure, we have advertising sales teams for automotive, consumer packaged goods, entertainment, finance, retail, pharmaceuticals, sports, technology, telecommunications, travel and advertising agencies. In international markets, our own internal sales representatives handle our advertising sales. In some countries, where we have not established full operational capacity, we have established sales agency relationships.

Fees revenue consists of revenues generated from a variety of consumer and business fee-based services, including SBC Yahoo! DSL and SBC Yahoo! Dial, Yahoo! Personals, Small Business Services, Yahoo! Mail and Yahoo! Enterprise Solutions.

Listings revenue consists of revenues generated from a variety of consumer and business listings-based services, including access to the HotJobs database and classifieds, such as Yahoo! Autos, Yahoo! Real Estate and other search services. HotJobs career offerings are handled by a designated sales team.

COMPETITION

We operate in the market for Internet products and services, which is a highly competitive market characterized by rapid change, converging technologies, and increased competition from companies offering communication, information and entertainment integrated into other products and media properties.

Globally, our most significant competition is from Time Warner and Microsoft ("Microsoft" or "MSN"). Time Warner is an integrated media and communications company engaged in online services, cable, filmed entertainment, television network, music and publishing. Time Warner has access to a large potential customer base through its America Online ("AOL"), cable and publishing business units. Microsoft is the largest software company in the world and through its MSN network provides numerous Internet products and services and has alliances with companies involved with broadband access and various forms of digital interactivity. Microsoft's presence on computer desktops through packaged software products and their strategy to sell software through online subscriptions provides them a competitive advantage over us in providing software and services to online users. Both AOL and MSN have a direct billing relationship with a greater number of their users through access and other services

8

than we have with our users through certain of our premium services. This gives them a potential advantage over us in targeting the sale of enhanced services to their user base.

As a result of our recent acquisitions of Inktomi and Overture, we compete directly with other providers of Web search and related search services, including, among others, Ask Jeeves, Inc., Google Inc. and Looksmart, Ltd.

We also face competition from companies focused on markets where expertise in a particular segment of the market may provide them a competitive advantage over us. Two of these competitors, Amazon.com, Inc. and eBay Inc., are expanding their positions as e-commerce merchants to leverage advantages from the scale of their commerce platforms to offer informational and community features that are competitive with the services we provide.

Internationally, we compete with local portals that are predominantly supported by the local telecommunication providers, which gives them a potential competitive advantage over us because they typically already have a direct billing relationship with their users.

See the "Risk Factors" section below for additional information regarding competition.

PRODUCT DEVELOPMENT

We continually enhance existing services and develop new services to meet evolving consumer demand for technological innovation. Our domestic engineering and production teams are primarily located in our Sunnyvale, California headquarters and in Pasadena, California, Dallas, Texas and Bangalore, India. Locally-based teams handle most international production and engineering. We have developed internally, acquired or licensed the properties and services we offer.

INTELLECTUAL PROPERTY

We seek to protect our intellectual property through patent, copyright, trade secret and trademark law and through contractual restrictions, such as confidentiality agreements. We consider the Yahoo! trademark to be one of our most valuable assets and we have registered this trademark in the United States and other countries throughout the world.

EMPLOYEES

As of December 31, 2003, we had approximately 5,500 full-time employees. Our future success is substantially dependent on the performance of our senior management and key technical personnel, and our continuing ability to attract and retain highly qualified technical and managerial personnel. See the "Risk Factors" section below for a further discussion of certain risks related to our employees.

AVAILABLE INFORMATION

Yahoo!'s Website is located at http://www.yahoo.com. Yahoo! makes available free of charge, on or through its Website, its annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such reports with the Securities and Exchange Commission ("SEC"). Information contained on Yahoo!'s Website is not part of this report or any other report filed with the SEC.

RISK FACTORS

If our competitors are more successful in attracting and retaining customers and users, then our revenues could decline.

We compete with many other providers of online navigation, Web search, commercial search, information, entertainment, business, recruitment, community, electronic commerce and Internet access services. As we expand the scope of our Internet offerings, we will compete directly with a greater number of Internet sites, media companies, and companies providing business services across a wide range of different online services, including:

9

In order to compete effectively, we may need to expend significant internal engineering resources or acquire other technologies and companies to provide or enhance our capabilities. If we are unable to maintain or expand our customer and user base in the future, our revenues may decline.

Companies such as Time Warner's AOL and Microsoft may have a competitive advantage because they have greater access to content, maintain billing relationships with more customers and have access to established distribution networks.

We face significant competition from Time Warner's America Online business ("AOL" or "America Online") and Microsoft ("Microsoft" or "MSN"). The combination of America Online and Time Warner provides America Online with content from Time Warner's movie and television, music, books and periodicals, news, sports and other media holdings; access to a network of cable and other broadband delivery technologies; and considerable resources for future growth and expansion. The America Online/Time Warner combination also provides America Online with access to a broad potential customer base consisting of Time Warner's current customers and subscribers of its various media properties. To a less significant extent, we also face competition from other companies that have combined a variety of services under one brand in a manner similar to Yahoo!. In certain of these cases, most notably AOL and MSN, our competition has a direct billing relationship with a greater number of their users through access and other services than we have with our users through certain of our premium services. This relationship permits our competitors to have several potential advantages including the potential to be more effective than us in targeting services and advertisements to the specific taste of their users.

Our recent acquisitions of Inktomi and Overture expose our business to greater competition in the area of algorithmic Web search and paid inclusion services.

In March 2003 we completed our acquisition of Inktomi Corporation ("Inktomi"), a provider of algorithmic Web search and paid inclusion services. In addition, we completed our acquisition of Overture Services, Inc. ("Overture") in October 2003, increasing our algorithmic Web search and paid inclusion business through Overture's Alta Vista and Fast Search & Transfer Web search businesses. As a result of these acquisitions, we compete directly with other providers of Web search and related search services, including, among others, AskJeeves, Inc., Google Inc, and LookSmart, Ltd. Some of these competitors may have longer operating histories focusing on providing Web search services, larger customer or user bases and greater brand recognition for their Web search businesses. In addition to the general acquisition risks highlighted in these risk factors, we are subject to the risk that other companies with greater operational, strategic, financial, personnel or other resources may choose to enter the Web search or paid inclusion spaces by acquisition or internal development, and may create greater competition for advertisers, customers and users.

If Overture fails to maintain its advertiser, user, business and affiliate constituencies, our revenues could significantly decline and our business could be adversely affected.

Overture's pay-for-performance search service is comprised of advertiser-generated listings, which are screened for relevance and accessed by users and businesses through the Yahoo! properties and through Overture's affiliates, a network of other Web properties that have integrated Overture's search service into their sites or that direct user traffic to Overture's sites. The search listings are ranked according to the advertiser's bid; that is, the higher the bid, the higher the ranking. Advertisers pay Overture the bid price for clicks on the advertiser's search listing (also known as a paid introduction, click-through or a paid click). Overture's success in pay-for-performance search services depends in part on the maintenance of a critical mass of advertisers, users, and traffic generated by the Yahoo! properties and Overture's affiliates. Such a critical mass encourages increased participation in Overture's paid placement search marketplace. To the extent Overture experiences a decline in the number of any of these constituents, the value of Overture's paid placement service could be harmed, and our revenues or business could be adversely affected.

Our recent acquisition of Overture exposes our business to greater competition with providers of pay-for-performance advertising search services.

As a result of our acquisition of Overture, we compete directly with other providers of pay-for-performance advertising services that are similar to Overture's, including Espotting Media, Inc. (which is under agreement to be acquired by FindWhat), FindWhat.com, Google Inc, LookSmart, Ltd., and Terra Lycos. In addition, we believe it is likely that there will be additional entrants to the pay-for-performance search market. Some of these entrants

10

may have greater operational, strategic, financial, personnel or other resources than we do, as well as greater brand recognition. These competitors compete against Overture for affiliate arrangements and could cause Overture to enter into affiliate arrangements with less favorable terms, lose current affiliates or not acquire new affiliates, which could reduce the number of click-throughs, increase the amount of revenue shared with affiliates, and reduce total revenues and thereby harm our business, operating results and financial condition.

Acquisitions could result in operating difficulties.

As part of our business strategy, we acquired Inktomi in March 2003, Overture in October 2003, 3721 Network Software Company Limited ("3721") in January 2004, and have completed several other acquisitions since inception. We expect to enter into additional business combinations and acquisitions in the future. Acquisitions may result in dilutive issuances of equity securities, use of our cash resources, incurrence of debt and amortization of expenses related to intangible assets. The acquisitions of Inktomi, Overture and 3721 were accompanied by a number of risks, including:

We may experience similar risks in connection with our future acquisitions. We may not be successful in addressing these risks or any other problems encountered in connection with the acquisitions of Overture, Inktomi and 3721 or that we could encounter in future acquisitions, which would harm our business or cause us to fail to realize the anticipated benefits of our acquisitions.

We may be subject to intellectual property infringement claims, which are costly to defend and could limit our ability to provide certain content or use certain technologies in the future.

Many parties are actively developing search, indexing, electronic commerce and other Web-related technologies, as well as a variety of online business models and methods. We believe that these parties will continue to take steps to protect these technologies, including, but not limited to, seeking patent protection. As a result, disputes regarding the ownership of these technologies and rights associated with online business are likely to arise in the future. In addition to existing patents and intellectual property rights, we anticipate that additional third-party patents related to our services will be issued in the future. From time to time, parties assert patent infringement claims against us in the form of letters, lawsuits and other forms of communications. Currently, we are engaged in several lawsuits regarding patent issues and have been notified of a number of other potential disputes. We expect that we will increasingly be subject to patent litigation as our services expand.

In addition to patent claims, third parties have asserted and most likely will continue to assert claims against us alleging infringement of copyrights, trademark rights, trade secret rights or other proprietary rights, or alleging unfair competition or violations of privacy rights. Currently, our subsidiary LAUNCH Media, Inc. ("LAUNCH") is engaged in a lawsuit regarding copyright issues that commenced prior to our acquisition of LAUNCH. In addition, Overture is in litigation with several companies, each of which has claimed that allowing advertisers to bid on certain search terms constitutes trademark infringement.

11

In the event that there is a determination that we have infringed third-party proprietary rights such as patents, copyrights, trademark rights, trade secret rights or other third party rights such as publicity and privacy rights, we could incur substantial monetary liability, be required to enter into costly royalty or licensing agreements, if available, or be prevented from using the rights, which could require us to change our business practices in the future. We may also incur substantial expenses in defending against third-party infringement claims regardless of the merit of such claims. As a result, these claims could harm our business.

Our intellectual property rights are valuable and any inability to protect them could dilute our brand image or harm our business.

We regard our copyrights, patents, trademarks, trade dress, trade secrets, and similar intellectual property, including our rights to certain domain names, as important to Yahoo!'s success. Effective trademark, patent, copyright, and trade secret protection may not be available in every country in which our products and media properties are distributed or made available through the Internet. Further, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. If we are unable to protect our trademarks from unauthorized use, our brand image may be harmed. While we attempt to ensure that the quality of our brand is maintained by our licensees, our licensees may take actions that could impair the value of our proprietary rights or the reputation of our products and media properties. We are aware that third parties have, from time to time, copied significant content available on Yahoo! for use in competitive Internet services. Protection of the distinctive elements of Yahoo! may not be available under copyright law. Any impairment of our brand image could harm our business and cause our stock price to decline. In addition, protecting our intellectual property and other proprietary rights can be expensive. Any increase in the unauthorized use of our intellectual property could make it more expensive to do business and consequently harm our operating results. In turn, this could harm the results of our business and lower our stock price.

Our international segment competes with local Internet service providers that may have a competitive advantage.

On an international level, we compete directly with local ISPs; they may have several advantages, including greater knowledge about the particular country or local market and access to significant financial or strategic resources in such local markets. We must continue to improve our product offerings, obtain more knowledge about our users and their preferences, deepen our relationships with our users as well as increase our branding and other marketing activities in order to remain competitive and strengthen our international market position.

Financial results for any particular period will not predict results for future periods.

There can be no assurance that the purchasing pattern of customers advertising on the Yahoo! network will not continue to fluctuate, that advertisers will not make smaller and shorter-term purchases, or that market prices for online advertising will not decrease due to competitive or other factors. In addition, there can be no assurance that the volume of searches conducted, the amounts bid by advertisers for search listings or the number of advertisers that bid on the Overture service will not vary widely from period to period. As revenues from sources other than advertising increase, it may become more difficult to predict our financial results based on historical performance. Because of the rapidly changing market we serve, period-to-period comparisons of operating results are not likely to be meaningful. You should not rely on the results for any period as an indication of future performance.

We expect our operating expenses to continue to increase as we attempt to expand the Yahoo! brand, fund product development, develop media properties and acquire other businesses.

Yahoo! currently expects that its operating expenses will continue to increase as we expand our operations in areas of expected growth, continue to develop and extend the Yahoo! brand, fund greater levels of product development, develop and commercialize additional media properties and premium services, and acquire and integrate complementary businesses and technologies. If our expenses increase at a greater pace than our revenues, our operating results could be harmed.

We may be required to record a significant charge to earnings if we must reassess our goodwill or amortizable intangible assets.

We are required under generally accepted accounting principles to review our amortizable intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill is required to be tested for impairment at least annually.

12

Factors that may be considered a change in circumstances indicating that the carrying value of our amortizable intangible assets may not be recoverable include a decline in stock price and market capitalization, and slower growth rates in our industry. We may be required to record a significant charge to earnings in our financial statements during the period in which any impairment of our goodwill or amortizable intangible assets is determined. At December 31, 2003, our goodwill and amortizable intangible assets were $2.3 billion. In the first quarter of 2002, we recorded a transitional impairment charge of $64 million as a cumulative effect of an accounting change, upon the adoption of Statement of Financial Accounting Standards No. 142 "Goodwill and Other Intangible Assets."

The majority of our revenues are derived from marketing services. Demand from our current and potential clients for online advertising is difficult to forecast accurately.

For the fiscal year ended December 31, 2003, approximately 74 percent of our total revenues came from marketing services. Our ability to continue to achieve substantial advertising revenue depends upon:

Our agreements with advertisers and sponsors generally have terms of three years or less and, in many cases, the terms are one year or less or in the case of Overture's business, may be immediately terminable by the advertiser. The agreements often have payments contingent on usage or "click-through" levels. Accordingly, it is difficult to forecast these revenues accurately. However, our expense levels are based in part on expectations of future revenues, include guaranteed minimum payments to our affiliates in connection with our pay-for-performance advertising services, and are fixed over the short-term with respect to certain categories. We may be unable to adjust spending quickly enough to compensate for any unexpected revenue shortfall.

Overture depends on a limited number of sources to direct users and businesses to its service to conduct searches.

The users and businesses that conduct searches on Overture's service come from a limited number of sources. In addition to the Yahoo! properties, sources for users conducting searches are members of Overture's affiliate network, including portals, browsers, and other affiliates. Overture's agreements with affiliates vary in duration, and depending on the agreement, provide varying levels of discretion to the affiliate in the implementation of the Overture service, including the degree to which affiliates can modify the presentation of the Overture search results on their websites or integrate the Overture services with their own services, and may be terminable upon the occurrence of certain events, including failure to meet certain service levels, material breaches of agreement terms, changes in control (including the change of control of Overture which occurred with Yahoo!'s acquisition of Overture) or in some instances, at will. Overture may not be successful in renewing any of its affiliate agreements, or if they are renewed, they may not be on as favorable terms. The loss of any of these affiliates or adverse change in implementation of the Overture service by our affiliates could harm our ability to generate revenue and our operating results.

Decreases or delays in advertising spending due to general economic downturns could harm our ability to generate advertising revenue.

Expenditures by advertisers tend to be cyclical, reflecting overall economic conditions as well as budgeting and buying patterns. In the recent past, the overall market for advertising, including Internet advertising, was generally characterized by softness of demand and the reduction of marketing and advertising budgets or the delay in

13

spending of budgeted resources. As a result, advertising spending decreased. Since Yahoo! derives a large part of its revenues from advertising fees, any decreases in or delays of advertising spending could reduce our revenues or negatively impact our ability to grow our revenues. Even as economic conditions improve, marketing budgets and advertising spending may not increase from current levels.

Due to intense competition, we may not be able to generate substantial revenues from the Internet access market.

In 2002 we launched SBC Yahoo! DSL and SBC Yahoo! Dial, an Internet access service provided through an alliance with SBC Communications Inc. In 2003 we launched BT Yahoo! Internet, a range of broadband and dial-up Internet access services provided in the United Kingdom through an alliance with British Telecommunications plc ("BT"). These access services combine customized content and services from Yahoo! (including browser and other communications services) and DSL transport and Internet access from SBC Internet Services (an affiliate of SBC Communications Inc.) and BT. These Internet access services compete with many large companies, some of which may have substantially greater market presence (including an existing user base), financial, technical, marketing or other resources than those committed to the product offerings with SBC and BT. In the United States, these services primarily compete directly or indirectly with established Internet services, such as AOL and MSN; other national telecommunications companies and regional Bell operating companies; and broadband Internet access providers such as Earthlink, Inc., Comcast Corporation, and other cable broadband providers. In the United Kingdom, these services primarily compete directly or indirectly with established Internet services, such as AOL and Freeserve plc; other major UK Internet service providers; and cable broadband providers such as NTL Incoporated and Telewest Communications. As a result of these and other competitive factors, these services may not be able to attract, grow or retain a customer base, which would negatively impact our ability to sell customized content and services through this channel.

Our success in the Internet access market will depend on technical and customer service issues, which we have a limited ability to control.

Internet access services, including SBC Yahoo! DSL, SBC Yahoo! Dial and BT Yahoo! Internet, are susceptible to natural or man-made disasters such as earthquakes, floods, fires, power loss, or sabotage, as well as interruptions from technology malfunctions, computer viruses or hacker attacks. Other potential service interruptions may result from unanticipated demands on network infrastructure, increased traffic or problems in customer service to our access customers. Our ability to control technical and customer service issues is further limited by our dependence on SBC and BT for connectivity, customer service, joint marketing and technical integration of aspects of our access service. Significant disruptions in our access service could harm our goodwill, the Yahoo! brand and ultimately could significantly and negatively impact the amount of revenue we may earn from our service.

Some of our sponsorship arrangements may not generate anticipated revenues.

A key element of our strategy is to generate marketing services revenue through sponsored services and placements by third parties in our online media properties in addition to banner advertising. We typically receive sponsorship fees or a portion of transactions revenue in return for minimum levels of user impressions to be provided by us. These arrangements expose us to potentially significant financial risks in the event our usage levels decrease, including the following:

14

Accordingly, any leveling off or decrease of our user base (or usage by our existing base) or the failure to generate anticipated levels of shared transactions revenue could result in a significant decrease in our revenues.

We may not be successful in expanding the number of users of our electronic commerce services.

We have focused, and intend to continue to focus, significant resources on the development and enhancement of our electronic commerce properties, such as Yahoo! Shopping. The success of our electronic commerce properties depends on, among other things, our ability to attract and retain well-known brands among our network of retailers, the ability to generate traffic to our commerce properties, and, in the case of Yahoo! Shopping, the rate at which users click through to product search results. Through our electronic commerce properties, we do not establish a direct billing relationship with our users as a result of any purchases they may make with the retailers. The revenue that we derive from our electronic commerce properties is typically in the form of lead-based fees, wherein retailers pay a fee based on the number of times a user clicks on a link to their site, transaction fees, and advertising fees. Users who had a favorable buying experience with a particular retailer may contact that retailer directly for future purchases rather than through our service. If our users bypass our electronic commerce properties, such as Yahoo! Shopping, and contact retailers directly, our revenue could decline. Competing providers of online shopping, including merchants with whom we have relationships, may provide a more convenient and comprehensive online shopping experience due to their singular focus on electronic commerce. As a result, we may have difficulty competing with those merchants for users of electronic commerce services and as a consequence our revenue could decline or we could fail to generate significant revenues from electronic commerce.

We will continue to operate in international markets in which we have limited experience and are faced with relatively higher costs and are exposed to greater risks.

A key part of our strategy is to develop Yahoo!-branded online properties and expand our commercial search offerings in international markets. We have developed, through joint ventures, subsidiaries and branch offices, localized properties in over 20 international countries. We also provide search services in 15 international countries. To date, we have only limited experience in marketing and operating our products and services internationally, and we rely on the efforts and abilities of our foreign business partners in such activities.

We believe that in light of substantial competition, we need to expand our operations in international markets quickly in order to obtain market share effectively. However, in a number of international markets, especially those in Europe, we face substantial competition from Internet Service Providers ("ISPs") that offer or may offer their own navigational services and from other companies that provide commercial search services. Many of these companies have a dominant market share in their territories. Furthermore, foreign providers of competing online services may have a substantial advantage over us in attracting users in their country due to more established branding in that country, greater knowledge with respect to the tastes and preferences of users residing in that country and/or their focus on a single market. We have experienced and expect to continue to experience higher costs as a percentage of revenues in connection with the development and maintenance of our international online properties relative to our domestic experience. We have selected international markets that may not develop at a rate that supports our level of investment. In particular, certain international markets may be slower than domestic markets in adopting the Internet as an advertising and commerce medium.

Our international operations are subject to increased risks.

In addition to uncertainty about our ability to continue to generate revenues from our foreign operations and expand our international presence, there are certain risks inherent in doing business on an international level, including:

15

One or more of these factors could harm our future international operations and consequently, could harm our business, operating results, and financial condition.

If key personnel leave unexpectedly and are not replaced, we may not be able to execute our business plan.

We are substantially dependent on the continued services of our key personnel, including our two founders, our chief executive officer, chief financial officer, chief operating officer, chief technical officer, and our executive and senior vice presidents. These individuals have acquired specialized knowledge and skills with respect to Yahoo! and its operations. In addition, as part of our integration of Overture's personnel and operations, we may lose key employees of Overture. If any of these individuals were to leave unexpectedly, we could face substantial difficulty in hiring qualified successors and could experience a loss in productivity while any such successor obtains the necessary training and experience. Many of our management personnel have reached or will soon reach the four-year anniversary of their Yahoo! hiring date and, as a result, have become or will shortly become fully vested in their initial stock option grants. While management personnel are typically granted additional stock options subsequent to their hire date, which will usually vest over a period of four years to provide additional incentive to remain at Yahoo!, the initial option grant is typically the largest for a given position, and an employee may be more likely to leave Yahoo! upon completion of the vesting period for the initial option grant.

If we are unable to hire qualified personnel in designated growth areas, we may not be able to execute our business plan.

We expect that we will need to hire additional personnel in designated growth areas. The competition for qualified personnel can be intense, particularly in the San Francisco Bay Area, where our corporate headquarters are located. At times, we have experienced difficulties in hiring personnel with the right training or experience, particularly in technical areas. If we do not succeed in attracting new personnel, or retaining and motivating existing personnel, we may be unable to meet our business plan and as a result our stock price may decline.

We may have difficulty scaling and adapting our existing architecture to accommodate increased traffic and technology advances or customer requirements.

Yahoo! is one of the most highly trafficked Websites on the Internet and is regularly serving numbers of users and delivering daily page views which are beyond previous standards for Internet usage. In addition, the services offered by Yahoo!, and popular with users and customers, have changed significantly in the past, are expected to change rapidly in the future, and are difficult to predict. Rapid increases in the levels or types of use of our online properties and services could result in delays or interruptions in our service. In particular, the architectures utilized for our services are highly complex and may not provide satisfactory service in the future, especially as the usage levels of email and certain other services increase, the rate of unsolicited email continues to increase in volume and complexity and the number of advertisers utilizing the Overture service increases. In the future, we may be required to make significant changes to our architectures, including moving to completely new architectures. If we are required to switch architectures, we may incur substantial costs and experience delays or interruptions in our service. These delays or interruptions in our service may cause users and customers to become dissatisfied with our service and move to competing providers of online services. Further, to the extent that demand for our services increases, we will need to expand our infrastructure, including the capacity of our hardware servers and the sophistication of our software. This expansion is likely to be expensive and complex, and require additional technical expertise. As we acquire users who rely upon us for a wide variety of services, it becomes more technologically complex and costly to retrieve, store and integrate data that will enable us to track each user's preferences. An unanticipated loss of traffic, increased costs, inefficiencies or failures to adapt to new technologies or user requirements and the associated adjustments to our architecture could harm our operating results and financial condition.

Our competitors often provide Internet access or computer hardware to our users, and our competitors could make it difficult for our users to access our services, which in turn, could reduce the number of our users.

Our users must access our services through an Internet access provider, including providers of cable and DSL

16

Internet access, with which the user establishes a direct billing relationship using a personal computer or other access device. To the extent that an access provider (other than those with which we have a relationship), such as AOL or MSN, or a computer or computing device manufacturer offers online services or properties that are competitive with those of Yahoo!, the user may find it more convenient to use the services or properties of that access provider or manufacturer. In addition, the access provider or manufacturer may make it difficult to access our services by not listing them in the access provider's or manufacturer's own directory. Also, because the access provider gathers information from the user in connection with the establishment of the billing relationship, the access provider may be more effective than us in tailoring services and advertisements to the specific tastes of the user. To the extent that a user opts to use the services offered by an access provider (other than those with which we have a relationship) or those offered by computer or computing device manufacturers rather than the services provided by us, our revenues may decline.

More individuals are utilizing non-PC devices to access the Internet, and versions of our service developed or optimized for these devices may not gain widespread adoption by users of such devices.

The number of individuals who access the Internet through devices other than a personal computer, such as personal digital assistants, mobile telephones and television set-top devices, has increased dramatically. Our services were originally designed for rich, graphical environments such as those available on desktop and laptop computers. The lower resolution, functionality and memory associated with alternative devices may make the use of our services through such devices difficult, and the versions of our service developed for these devices may not be compelling to users of alternative devices. As we have limited experience to date in operating versions of our service developed or optimized for users of alternative devices, it is difficult to predict the problems we may encounter in doing so, and we may need to devote significant resources to the creation, support and maintenance of such versions. If we are unable to attract and retain a substantial number of alternative device users to our online services, we will fail to capture a sufficient share of an increasingly important portion of the market for online services.

We rely on the value of the Yahoo! brand, and the costs of maintaining and enhancing our brand awareness are increasing.

We believe that maintaining and expanding the Yahoo! brand (and our other brands, including HotJobs, Inktomi, LAUNCH, and Overture) is an important aspect of our efforts to attract and expand our user and advertiser base. We also believe that the importance of brand recognition will increase due to the relatively low barriers to entry. We have spent considerable money and resources to date on the establishment and maintenance of the Yahoo! brands. We will spend increasing amounts of money on, and devote greater resources to advertising, marketing and other brand-building efforts to preserve and enhance consumer awareness of the Yahoo! brands. We may not be able to successfully maintain or enhance consumer awareness of the Yahoo! brands and, even if we are successful in our branding efforts, such efforts may not be cost-effective. If we are unable to maintain or enhance customer awareness of the Yahoo! brands in a cost effective manner, our business, operating results and financial condition would be harmed.

The successful operation of our business depends upon the supply of critical elements from other companies and any interruption in that supply could cause service interruptions or reduce the quality of our product offerings.

We depend upon third parties, to a substantial extent, for several critical elements of our business, including various technology, infrastructure, content development, software and distribution components.

Technology and Infrastructure. We rely on private third-party providers for our principal Internet connections, co-location of a significant portion of our data servers and network access. Any disruption in the Internet or network access or co-location services provided by these third-party providers or any failure of these third-party providers to handle current or higher volumes of use could significantly harm our business, operating results and financial condition. Any financial difficulties for our providers may have negative effects on our business, the nature and extent of which we cannot predict. We license technology and related databases from third parties for certain elements of our properties, including, among others, technology underlying the delivery of news, stock quotes and current financial information, chat services, street mapping and telephone listings, streaming capabilities and similar services. We have experienced and expect to continue to

17

experience interruptions and delays in service and availability for such elements. We also rely on a third-party manufacturer for key components of our email service. Furthermore, we depend on hardware and software suppliers for prompt delivery, installation and service of servers and other equipment to deliver our products and services. Any errors, failures, interruptions, or delays experienced in connection with these third-party technologies and information services could negatively impact our relationship with users and adversely affect our brand and our business and could expose us to liabilities to third parties.

Distribution Relationships. In addition to our relationships with SBC and BT, to increase traffic for our online properties and services and make them more available and attractive to advertisers and consumers, we have certain distribution agreements and informal relationships with, operators of online networks and leading Websites, electronics companies, and computer manufacturers. These distribution arrangements typically are not exclusive and do not extend over a significant amount of time. Further, some of our distributors are competitors or potential competitors who may not renew their distribution contracts with us. Potential distributors may not offer distribution of our properties and services on reasonable terms, or at all. In addition, as new methods for accessing the Web become available, including through alternative devices, we may need to enter into additional distribution relationships. If we fail to obtain distribution or to obtain distribution on terms that are reasonable, we may not be able to fully execute our business plan.

Streaming Media Software. We rely on the two leading providers of streaming media products, RealNetworks, Inc. and Microsoft, to license the software necessary to broadcast streaming audio and video content to our users. There can be no assurance that these providers will continue to license these products to us on reasonable terms, or at all. Our users are currently able to electronically download copies of the software to play streaming media free of charge, but providers of streaming media products may begin charging users for copies of their player software or otherwise change their business model in a manner that slows the widespread acceptance of these products. In order for our rich media services to be successful, there must be a large base of users of these streaming media products. We have limited or no control over the availability or acceptance of streaming media software, and to the extent that any of these circumstances occur, our business will be adversely affected.

Content and Search Service. Our future success depends upon our ability to aggregate compelling content and deliver that content through our online properties. We license much of the content that attracts users to our online properties, such as news items, stock quotes, weather reports, maps and audio and video content from third parties. In particular, our music and entertainment properties rely on major sports organizations, radio and television stations, record labels, cable networks, businesses, colleges and universities, film producers and distributors, and other organizations for a large portion of the content available on our properties. Our ability to maintain and build relationships with third-party content providers will be critical to our success. We may be unable to enter into or preserve relationships with the third parties whose content we seek to obtain. Many of our current licenses for third-party content extend for a period of less than two years and there can be no guarantee that they will be renewed upon their expiration. In addition, as competition for compelling content increases both domestically and abroad, our content providers may increase the prices at which they offer their content to us and potential content providers may not offer their content on terms agreeable to us. An increase in the prices charged to us by third-party content providers could harm our operating results and financial condition. Further, many of our content licenses with third parties are non-exclusive. Accordingly, other Webcasters may be able to offer similar or identical content. Likewise, most sports and entertainment content available on our online properties are also available on other media like radio or television. These media are currently, and for the foreseeable future will be, much more widely adopted for listening or viewing such content than the Web. These factors also increase the importance of our ability to deliver compelling editorial content and personalization of this content for users in order to differentiate Yahoo! from other businesses. If we are unable to license or acquire compelling content, if other companies broadcast content that is similar to or the same as that provided by Yahoo!, or if we do not develop compelling editorial content or personalization services, the number of users on our online properties may not grow at all or may grow at a slower rate than anticipated, which would harm our operating results.

18

As we provide more audio and video content, particularly music, we may be required to spend significant amounts of money on content acquisition and content broadcasts.

In the past, the majority of the content that we provided to our users was in print, picture or graphical format and was either created internally or licensed to us by third parties for little or no charge. However, we have been providing and intend to continue to provide increasing amounts of audio and video content to our users, such as the broadcast of music, film content, speeches, news footage, concerts and other special events, through our media and entertainment properties. We believe that users of Internet services such as the Yahoo! online properties will increasingly demand high-quality audio and video content. Such content may require us to make substantial payments to third parties from whom we license or acquire such content.

For example, in order to broadcast music through our online properties, we are currently required to pay royalties both on the copyright in the musical compositions and the copyright in the actual sound recordings of the music to be broadcast. The revenue we receive as a result of our audio and video broadcasts may not justify the costs of providing such broadcasts.

Our failure to manage growth and diversification of our business could harm us.

We have experienced dramatic growth in personnel since inception and expect to continue to hire additional personnel in selected areas. This growth requires significant time and resource commitments from us and our senior management. Further, as a result of recent acquisitions and international expansion, more than one-half of our employees are based outside of our Sunnyvale, California headquarters. If we are unable to effectively manage a large and geographically dispersed group of employees or anticipate our future growth, our business will be adversely affected.

Additionally, our business relies on our financial reporting and data systems (including our systems for billing users of our fee-based services), which have grown increasingly complex in the recent past due to acquisitions and the diversification and complexity of our business. Our ability to operate our business efficiently depends on these systems and if we are unable to adapt to these changes, our business will be adversely affected.

We are subject to U.S. and foreign government regulation of the Internet, the impact of which is difficult to predict.

We are subject to general business regulations and laws, as well as regulations and laws directly applicable to the Internet. As we continue to expand the scope of our properties and service offerings, the application of existing laws and regulations to Yahoo! relating to issues such as user privacy, defamation, pricing, advertising, taxation, gambling, sweepstakes, promotions, financial market regulation, consumer protection, content regulation, quality of products and services, and intellectual property ownership and infringement can be unclear. In addition, we will also be subject to new laws and regulations directly applicable to our activities. Further, the application of existing laws to Yahoo! or our subsidiaries regulating or requiring licenses for certain businesses of our advertisers including, for example, distribution of pharmaceuticals, alcohol, tobacco or firearms, as well as insurance and securities brokerage and legal services, can be unclear. Any existing or new legislation applicable to us could expose us to substantial liability, including significant expenses necessary to comply with such laws and regulations, and dampen the growth in use of the Web.