Sign in or join

Add a note by highlighting text or Replying to an existing note.

Add a note by highlighting text or Replying to an existing note.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2013

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 001-35678

FLEETMATICS GROUP PLC

(Exact Name of registrant as specified in its charter)

| Ireland | 27-3112485 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

| Block C, Cookstown Court Belgard Road Tallaght Dublin 24 Ireland |

||

| (Address of principal executive offices) | ||

Registrants telephone number, including area code: +353 (1) 413 1250

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Exchange on Which Registered |

|

| Ordinary Shares, 0.015 nominal value | New York Stock Exchange |

Securities to be registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrants knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of accelerated filer and large accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if small reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant, as of June 30, 2013, was approximately $603.0 million (based on the closing price of the registrants ordinary shares, 0.015 par value per share, on June 30, 2013, of $33.23 per share).

The number of shares outstanding of the registrants ordinary shares, 0.015 par value per share, as of February 28, 2014 was 37,133,857.

DOCUMENTS INCORPORATED BY REFERENCE

None.

ANNUAL REPORT ON FORM 10-K

YEAR ENDED DECEMBER 31, 2013

|

Page

No. |

||||||

| Part I |

|

|||||

| Item 1. |

3 | |||||

| Item 1A. |

15 | |||||

| Item 1B. |

35 | |||||

| Item 2. |

35 | |||||

| Item 3. |

35 | |||||

| Item 4. |

36 | |||||

| Part II |

||||||

| Item 5. |

37 | |||||

| Item 6. |

39 | |||||

| Item 7. |

Managements Discussion and Analysis of Financial Condition and Results of Operations |

43 | ||||

| Item 7A. |

69 | |||||

| Item 8. |

71 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

109 | ||||

| Item 9A. |

109 | |||||

| Item 9B. |

110 | |||||

| Part III |

||||||

| Item 10. |

111 | |||||

| Item 11. |

113 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

125 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

126 | ||||

| Item 14. |

127 | |||||

| Part IV |

||||||

| Item 15. |

128 | |||||

| 129 | ||||||

2

PART I

Except for the historical information contained herein, the matters discussed in this Annual Report on Form 10-K are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements involve risks and uncertainties. Fleetmatics makes such forward-looking statements under the provision of the Safe Harbor section of the Private Securities Litigation Reform Act of 1995. Any forward-looking statements should be considered in light of the factors described below in Item 1A Risk Factors. Actual results may vary materially from those projected, anticipated or indicated in any forward-looking statements. In this Annual Report on Form 10-K, the words anticipates, believes, expects, intends, future, could, and similar words or expressions (as well as other words or expressions referencing future events, conditions or circumstances) identify forward-looking statements. Unless the context otherwise requires, all references to Fleetmatics, we, our, us, our company, the Company or the Corporation in this Annual Report on Form 10-K refer to Fleetmatics Group PLC and its subsidiaries.

| Item 1. | Business |

Fleetmatics is a leading global provider of fleet management solutions delivered as software-as-a-service, or SaaS. Our mobile software platform enables businesses to meet the challenges associated with managing their local fleets of commercial vehicles and improve productivity by extracting actionable business intelligence from vehicle and driver behavioral data. We offer intuitive, cost-effective Web-based and mobile application solutions that provide fleet operators with visibility into vehicle location, fuel usage, speed and mileage and other insights into their mobile workforce, enabling them to reduce operating and capital costs, as well as increase revenue. As of December 31, 2013, we had approximately 22,000 customers who collectively deployed our solutions in over 445,000 vehicles worldwide. The substantial majority of our customers are small and medium-sized businesses, or SMBs, each of which deploys our solutions in 1,000 or fewer vehicles. During the year ended December 31, 2013, we collected an average of approximately 47 million data points per day from subscribers and have aggregated over 52 billion data points since our inception, which we believe provides a valuable data set that we may consider in the development of complementary business intelligence solutions and additional sources of revenue.

In August 2013, Fleetmatics acquired an Australian-based company, Connect2Field Holdings Pty Limited (Connect2Field), a privately-held provider of cloud-based software solutions for service businesses and their mobile workers. This product allows us to execute on a shared vision of enabling field service businesses globally by leveraging the prevalence of wireless data and mobile devices and giving them tools they need to automate, manage, simplify and improve their operations. We believe these solutions, particularly among small-to-medium-sized businesses where they are replacing manual processes that are often prone to inefficiency and errors, will help our customers improve customer service levels, increase mobile productivity and enhance savings.

Many SMBs manage their local fleets by using manual processes, such as entering data on time sheets and communicating with mobile employees using cellular phones, which generate minimal actionable business intelligence. Furthermore, existing technology-based solutions, including long haul-focused solutions, can be cost-prohibitive and difficult for SMBs to implement and use. Our multi-tenant SaaS solutions are designed to meet the needs of SMBs, overcome existing barriers to adoption, and leverage the volumes of data transmitted to us from in-vehicle devices over cellular networks that we aggregate and analyze from our large and growing subscriber base. By using our solutions to extract actionable business intelligence from the data on their fleet and mobile workforce, fleet operators gain greater control over fuel, maintenance, labor and other costs while improving the return on capital invested in their fleet.

We have developed a differentiated, cost-effective customer acquisition sales model based on leads sourced through both Web-based digital advertising, such as search engine marketing and optimization, email marketing

3

and our websites, and targeted outbound sales efforts. We design our Web-based marketing programs to drive visitors to our direct Web and field sales forces that use disciplined processes to qualify and convert these leads into paying customers. New customers typically enter into initial three-year subscription agreements with monthly billing, providing us with a high degree of visibility into future revenue.

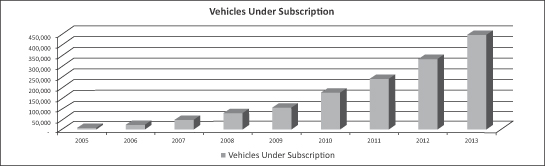

We have grown our customer base, the number of vehicles using our solutions and our revenue in each year since our incorporation in 2004. The following chart shows the aggregate number of vehicles under subscription for our fleet management solution as of December 31 for each of the years presented:

The chart above includes the number of vehicles under subscription with our subsidiary SageQuest, Inc., or SageQuest, since our acquisition of SageQuest in July 2010.

Our subscription revenue in 2013 grew 39.2% to $177.4 million compared to $127.5 million in 2012, an increase of 38.1% compared to $92.3 million in 2011. We reported net income in 2013 of $30.5 million compared to $5.4 million in 2012 and $2.9 million in 2011. Our Adjusted EBITDA in 2013 grew 66.7% to $56.5 million compared to $33.9 million in 2012, an increase of 55.8% from $21.7 million in 2011.(1)

| (1) | Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA, an explanation of our managements use of this measure and a reconciliation of our Adjusted EBITDA to our net income (loss), see Item 6Selected Financial Data. |

Our Solutions

Our SaaS solutions enable businesses to meet the challenges associated with managing their local fleets by extracting actionable business intelligence from vehicle and driver behavioral data. Our highly scalable multi-tenant architecture leverages GPS data transmitted from in-vehicle devices over cellular networks. Customers remotely access business intelligence reports through our intuitive interface using a standard Web browser or mobile application. The added visibility into their businesses and costs helps enable fleet operators to more appropriately price their services and budget their operations. We believe that our solutions benefit customers in the following ways:

Reduced operating costs. Our solutions help businesses reduce operating costs by automating fleet tracking and optimizing related processes. Businesses that use our solutions can monitor and manage route efficiency and reduce idle time, resulting in lower fuel costs and labor expenses, such as overtime pay. In addition, our software helps companies to monitor vehicle speeds, identify unauthorized usage, minimize fleet wear and tear as well as the likelihood of fines, and increase the prospects of recovering stolen vehicles. For example, our customers benefit from an average decrease of 14% in idling time per month between the first month of deploying our solutions and the thirty-sixth month of using our solutions.

Increased worker productivity and revenues. Our solutions enable our customers to enhance worker productivity by minimizing wasted time on and traveling to job sites, detecting extended breaks and unauthorized detours, and provide our customers with the ability to better align compensation with productivity. Additionally,

4

our monitoring and reporting capabilities shorten customer response times by facilitating the deployment of the nearest, most appropriate vehicle to a location, thereby improving customer service. For example, after deploying our fleet management solutions, one of our customers reported that its technicians completed approximately 50% more service calls per month over an 18-month period.

Designed for SMBs. Our Fleetmatics-branded products are competitively priced solutions designed to meet the needs of SMB fleet operators. Our solutions are easily and quickly implemented with the assistance of our large network of third-party installers, which generally allows businesses to begin using our solutions shortly after entering into a service contract. Our software is Web-based and can be accessed and used on mobile applications. Additionally, our solutions feature an intuitive graphical user interface with analytical dashboards, reports and alerts designed specifically for SMB fleet operators, which allows them to use the product without significant training or dedicated staff.

A robust platform for data aggregation. We aggregate data that is generated from the use of our solutions with data provided through partnerships, integration with third-party products, commercial or publicly available sources, and from our customers. This capability provides us with an opportunity to recognize trends and provide insights that complement our core product reports, such as long-term trending and driver scoring statistics, to help our customers optimize the performance of their fleet.

Highly scalable, reliable and cost-effective SaaS platform. We utilize a SaaS delivery model, which lowers operators costs by eliminating their need to own and support software or associated technology infrastructure. We have built our solutions to scale and support geographically-distributed fleets of any size as they grow. We support our solutions with redundant servers and other infrastructure in two principal data centers in the United States and Europe, providing global reach and security. Our data centers maintained over 99.9% system uptime during the year ended December 31, 2013. Our fleet management solutions can be deployed, maintained and used without significant hardware costs, dedicated information technology personnel and infrastructure.

Ability to integrate third-party products and services. Our software architecture facilitates integration with third-party applications and services such as fuel cards, mapping and work order integration solutions and other value-added software and services. This enables fleet operators of any size to leverage our solutions across their existing software platforms and gain access to a broader spectrum of fleet management tools that we offer including enhanced reporting for fleet operators and other efficiency tools for drivers.

Device and network agnostic. Our fleet management solutions can be accessed over personal computers, tablets or smart phones, providing our customers with significant flexibility in how they access the business insights we provide. Our solutions are hardware and network agnosticwe can collect and analyze large volumes of complex vehicle and behavior data irrespective of the hardware generating the data or the cellular network over which the data is transmitted.

Our Key Competitive Strengths

We believe that the following competitive strengths differentiate us from our competitors and are key to our success:

Efficient and scalable customer acquisition model. We have developed a scalable sales and marketing model that is focused on the efficient generation of a large number of customer leads, primarily through digital advertising, such as search engine marketing and optimization and email marketing as well as targeted outbound sales efforts. These techniques provide us with a flow of low-cost, qualified leads, both in the U.S. and internationally. Our sales and marketing team uses disciplined processes to convert these leads into paying subscribers. In particular, our Web sales team has historically increased our overall sales productivity while lowering the aggregate cost of customer acquisition by focusing on sales to ever larger and more sophisticated customers using phone and live Web demonstrations rather than traditional in-person meetings. We believe our marketing approach provides us with a cost-efficient and highly effective means of targeting and accessing the vast and geographically diverse SMB market and converting leads into paying subscribers.

5

Business intelligence approach to fleet management. Our approach to fleet management is based on our proprietary business intelligence software that enables our customers to analyze large volumes of complex vehicle and driver behavioral data by accessing over 40 pre-built reports online through an intuitive dashboard. Our technology platform enables users to consolidate large, disparate data sets and identify relationships and long-term historical trends within data through proactive prompts or when requested by the user. We believe that our solutions provide our customers with insights that help them make more informed and timely business decisions.

Software-as-a-Service model. Our SaaS-based solutions are offered through a subscription over the Internet and use a multi-tenant architecture, which enables us to run a single instance of our software code, add subscribers with minimal incremental expense and deploy new applications and upgrades quickly and efficiently. Our SaaS model is particularly well suited for SMBs, which typically lack the personnel qualified to support on-premises deployments and generally wish to avoid large up-front software and hardware expenditures. Initial subscription agreements are typically 36 months in duration, providing significant revenue visibility to us.

Deep domain expertise. From inception, we have focused on small and medium-sized fleet markets. This focus enables us to understand the specific needs of SMB fleet operators as they evolve. We possess significant experience and expertise in fleet management solutions, which enable us to develop, implement and sell SaaS solutions purpose-built for our existing and prospective customers. We also believe that the data that we collect and analyze represents a significant, rapidly-growing and valuable asset, which we can use to generate industry-specific benchmarking statistics.

Large and growing ecosystem of fleets and vehicles. As of December 31, 2013, we had approximately 22,000 customers who deployed our solutions in over 445,000 vehicles worldwide. In addition, our customers ran approximately 2.4 million reports and generated over one billion data points in December 2013. This vast amount of data not only provides valuable information for our business intelligence offerings, but also provides us with opportunities for increased revenue. For example, we organize and aggregate this data, render it anonymous and sell it to traffic reporting vendors. Our large deployment footprint also provides us with an audience to whom we can market and sell incremental solutions, such as integration with fuel cards and GPS navigation devices, or third-party complementary products and services. Our established customer base also contributes to our brand recognition and economies of scale.

Our Offerings

We offer fleet management software solutions that our customers use to gain visibility into their fleet and mobile workforce. Our Fleetmatics-branded solutions sold under the Fleetmatics or SageQuest names, are purpose-built to meet the needs of SMB customers using a multi-tenant architecture that we host in third-party data centers. Our solutions are accessed through a Web browser or mobile application and provide our customers with actionable business intelligence. Our core SaaS offering, which is included with all customer subscriptions, consists of the following easy-to-use components:

Tracking Alerts. Our Fleet Tracking Alerts allow fleet operators to set driver performance thresholds and receive email notifications when unwanted driving behavior occurs. Notifications are sent when a vehicle enters or exits specified areas, moves during specified times, or when a vehicles speed or idle time exceeds specified thresholds.

Route Replay. Our Route Replay feature allows customers to play back each journey taken by their vehicles, from start up to shut down and provides customers with minute-by-minute location and speed details. Fleet operators can start, stop, pause, and change the speed of the journey replay using intuitive playback controls to monitor and analyze driver behavior. Integration with Google Maps enables customers to pinpoint vehicle location with satellite, street views and zooming capabilities.

6

Geofencing and Landmarks. Our Geofencing and Landmarks feature allows customers to easily designate areas on the map in which vehicles are allowed or not allowed to travel. Fleet operators receive notifications when a vehicle enters or exits an unauthorized location and reports are generated detailing time spent in unauthorized areas.

FleetTracking Dashboard. Our FleetTracking Dashboard provides fleet operators with a convenient way to monitor overall fleet performance through an intuitive graphical summary. This interface allows fleet operators to evaluate performance categories across their fleet, including average speed, engine on-time, vehicle idling, vehicle mileage and number of stops. Fleet operators can also view individual vehicle performance.

Fleet Reports. We provide our customers with over 40 pre-built on-demand reports that they can easily access to analyze fleet data. Our reports contain detailed information about vehicle movement and use, including vehicle location, ignition on and off time, engine idle time, arrival and departure times, distance traveled, hours worked, and vehicle speed. Additionally, customers can set acceptable threshold limits for these performance metrics and have reports generated that detail exceptions. Reports can be run at any time or be scheduled to run automatically with the results emailed to any number of recipients on a daily or weekly basis.

Mobile App. Our Mobile App is a full-featured, portable software application that fleet operators can use to access current actionable business intelligence and insights over mobile devices. It includes the FleetTracking Dashboard, Reports, Tracking Alerts, Route Replay, and Geofencing and Landmarks.

Speed Limits. Most GPS vehicle tracking solutions limit visibility into speeding on only interstates and highways. With our Speed Limits feature, we provide a comprehensive source of speed limit information across all types of roads and geographies, including local and residential roads. Speed Limits is powered by Fleetmatics RoadSpeed, a specialized database of average speed values derived from billions of points of vehicle movement.

Panoramic Reporting and Benchmarking. Our panoramic reporting engine features in-depth historical trending analyses and strategic comparative information from the customers, such as driver and organizational performance benchmarking. Many of our customers want the perspective of knowing how their fleet should be performing when compared to those of similar businesses, industries and locations. Our industry benchmarking feature provides that analysis for the users individual needs, providing deep insight into each vehicles performance and identifying impactful opportunities for improvement. We believe we have one of the largest subscriber bases in the vehicle tracking industry and billions of position points received and that we are in a strong position to provide industry benchmarks with high credibility and relevance at a local level.

In addition to this core SaaS offering, we also offer the following additional features at an additional cost to our customers:

Fuel Card Reporting Integration. Our Fuel Card Reporting Integration feature integrates customers current fuel card usage information into our fleet management software platform. It provides our customers with an on-demand fuel usage summary for an entire fleet as well as detailed information on individual vehicles. Reports are generated that compare fuel purchases with vehicle location data.

Fleetmatics Fuel Card. As an expansion of Fuel Card Reporting, we have partnered with a leading independent global fleet card provider to deliver a Universal Platinum MasterCard. This partnership delivers flexible billing and payment options, personal assistance and training to establish controls and optimize savings, and strong and customizable purchasing controls.

Navigation Unit Integration. Our Navigation Unit Integration feature, currently with Garmin GPS navigation devices, streamlines dispatching and communication by integrating our fleet management software with our customers GPS navigation devices. It provides customers with turn-by-turn directions, notification of job status, estimated time of arrival to the next job site, and easy-to-use messaging capabilities. Drivers receive automatic job updates, eliminating the need to manually enter addresses while driving.

7

All of these components are fully integrated into our SaaS solutions.

Additionally, we provide a standalone offering with the recent acquisition of Connect2Field at an additional cost to our customers:

Field Service Management. This new offering allows SMB fleets to store all of their companys information in the cloud, automating their back office activities. Included in this offering is the ability to manage jobs, schedules, invoices and fieldworkers.

Marketing and Sales

Marketing

Our marketing programs target owners and managers in the service and distribution industries that operate fleets of commercial vehicles. Our marketing strategy is focused on building brand awareness, generating quality leads and reinforcing customer engagement and thought leadership.

Lead generation is a core function of our business processes. We generate leads through a combination of Web-driven inbound activities and traditional outbound marketing activities.

Inbound leads. Our inbound leads are largely generated through Web-based marketing efforts. This involves extensive search engine marketing, search engine optimization, digital advertising, email marketing, direct Web traffic and programs with digital media companies.

Our demand generation programs vary depending on our target industry or fleet size, and include marketing activities, such as integrated programs on the Web, outbound marketing campaigns targeted to prospects in key industries and geographies, attendance and sponsorship of trade shows, email lead generation and prospect follow-up and traditional public relations and website properties. We make use of social media to engage customers and prospects to generate interest, demand and leads.

Outbound leads. Our outbound lead generation involves a variety of traditional marketing activities, including direct mail, email marketing, cold calling, advertising, trade shows and in-person events, and telemarketing.

We accumulate marketing lists through a variety of sources, including purchased lists selected by industry and geographic demographics. We filter prospects by using industry group and vertical market benchmarks to identify quality targets. Additionally, we utilize research techniques and analytic lead scoring models to identify those outbound leads that we believe have the greatest likelihood for us to convert to a sales presentation and a subscription.

Sales

We sell our subscriptions to our fleet management solutions through our direct sales organization. Maintaining direct control of our sales force allows us to efficiently target small to medium-sized businesses with a local fleet. We have direct sales operations in the U.S. as well as internationally in the United Kingdom, Ireland, and Australia.

The focus of our sales efforts is to drive a high volume of transactions through a standardized and highly repeatable methodology. We focus on the core challenges that fleet operators face in managing their fleet. We are able to provide our prospects with an anticipated return on investment, or ROI, calculation that enables us to tangibly demonstrate the benefits of our solutions and how they address the challenges that our prospects face. We highlight the insights that fleet operators gain from our reports and alerts and how they can use those insights to improve productivity, increase operating profits and solve key business problems.

8

We effectively sell our SageQuest branded solutions to large customers because those solutions satisfy their administrative, mapping and integration requirements. We have dedicated sales and marketing teams for both our FleetMatics and SageQuest branded products that utilize the following sales channels, depending on our customers needs and fleet sizes:

Web sales. Our primary sales channel and a key component of our go-to-market strategy, the Web sales team has historically increased its sales productivity while lowering the aggregate cost of customer acquisition. The Web sales team conducts its selling activities over the phone using live Web demonstrations to convert sales leads to customers.

Field sales. Our field sales team meets face-to-face with prospects and focuses on sales to customers with larger fleet sizes. A team of inside telesales representatives supports this field sales team.

Existing customer account sales. We have a sales team dedicated exclusively to existing accounts that focus on up-selling and cross-selling additional products to our customer base, securing renewal agreements, and promoting our customer referral program. This team is also focused on assisting customers that are adding units through fleet expansion or broader use of additional features across their fleet. This team monitors customer usage to ensure that our customers are deriving the maximum benefit from our offering.

Technology, Operations, and Development

Technology

We designed our SaaS solutions architecture so that our customers may access them via a Web browser or mobile application. Updates to our solutions are distributed instantaneously to all of our customers over the Web. Our solutions have been specifically built to deliver:

| | a consistent, intuitive end-user experience to limit the need for training and to encourage high levels of end-user adoption and engagement; |

| | turnkey, out-of-the-box functionality; |

| | flexibility to design customized reports and alerts that enable our clients to gain insights into their existing fleet and mobile assets; |

| | integration with other systems such as fuel cards, GPS navigation devices, and customer information technology systems, such as work order management and enterprise resource management systems; |

| | scalability to match the needs of our growing customer base and their fleets; and |

| | rigorous security standards and high levels of system performance and availability demanded by our customers. |

Our fleet management system is comprised of an in-vehicle device that incorporates off-the-shelf components, including a cellular modem, GPS receiver and memory capacity sufficient to run our proprietary firmware, which reports vehicle coordinates, time, speed, ignition status, and mileage from satellite readings. This information is collected at a predefined frequency (generally every 30-90 seconds) and then sent to our receivers at third-party data centers, via a commercial cellular network. The information is then processed and delivered to our customers providing a wide range of live reporting, mapping and alerts designed to give customers business intelligence. This information can be accessed by our customers via a Web browser or mobile application as well as be sent to customers by email, an XML feed or Web services.

Our SaaS solutions are deployed using a multi-tenant architecture that scales rapidly to support additional new subscribers through the addition of incremental commodity processing and storage hardware. This architecture flexibility allows us to sustain high levels of uptime without degradation of system performance despite significant subscriber growth. Our existing architecture and infrastructure has been designed with sufficient capacity to meet our current and anticipated future needs.

9

We are standardized on Microsoft .NET frameworks and write the majority of our software in industry-standard software programming languages, such as C#. We use technologies, such as AJAX, extensively to enhance the usability, performance, and overall user experience of our solutions. Microsoft SQL Server software is deployed for our relational database management system. Apart from these and other third-party industry standard technologies, our fleet management solutions have been specifically built and upgraded by our in-house development team.

In 2013, we collected an average of 47 million data points per day. To date, we have aggregated over 52 billion data points. We analyze, cleanse and mine customer-specific data to deliver business intelligence upon which our customers can base business decisions. We also use this information to provide our customers with long-term trending, driver scoring and industry-wide competitive benchmarking.

Operations

We physically host our SaaS solutions for our customers principally in three secure third-party data centers, in Solon, Ohio, Denver, Colorado, and Dublin, Ireland. These data management facilities provide us with both physical security, including manned security 365 days a year, 24 hours a day, seven days a week, biometric access controls and systems security, including firewalls, encryption, redundant power and environmental controls. Our data centers maintained over 99.9% system uptime in 2013. We believe that our third-party hosting facilities are adequate for our current needs and that suitable additional capacity will be available as needed to accommodate planned expansion of our operations. We believe our agreements with these third-party data centers are generally consistent with competitive market terms and conditions.

Our infrastructure includes firewalls, switches, routers, load balancers, IDS/IPS and application firewalls from top-tier suppliers to serve as the networking infrastructure and high levels of security for the environment. We use rack-mounted servers to run our solutions and for content caching. We use storage area network, or SAN, hardware with fibre channel and solid-state drives at our data center locations. These SAN systems have been architected for high performance and data-loss protection, and we believe that these systems have the capacity and scalability to support our anticipated growth for the foreseeable future.

We leverage our third-party network of approximately 850 installers worldwide to install our in-vehicle devices. Upon contracting with a new customer, we dispatch the nearest installer to the customers place of business or a central location for installation of our in-vehicle devices. Typically, the full installation cycle is accomplished within 15 days from the date of contract. If an in-vehicle device malfunctions in the field, we also call on our installer network to replace the device.

Customers and Support

Since inception, we have maintained a consistent focus on SMBs. As of December 31, 2013, we served a large and diverse group of approximately 22,000 customers with an aggregate of over 445,000 vehicles under subscription. We serve a wide range of customers in the service and delivery industries, including plumbing, heating, construction, engineering services, transportation, electrical and various other services. Approximately two-thirds of our U.S. customers vehicles travel fewer than 200 miles per day and nearly 90% operate within a 50 mile radius each day. In addition, we have found that our solutions, particularly when integrated with work order management systems, provide value to larger field service organizations, including in the cable and telecommunications industries. For example, we count the regional service organizations for many cable and telecommunication companies as customers. We have low customer concentration. In 2013 and 2012, our largest customer accounted for approximately 4% and 3%, respectively, of our subscription revenue and our top 25 customers represented approximately 13% and 11%, respectively, of our subscription revenue. We measure customer satisfaction on an annual basis by surveying our customers. Based on these surveys, we believe that our overall customer satisfaction is strong.

10

We provide customer support as part of our subscription. Our internal teams are proactive and contact our customers by phone to help them utilize additional features of our solutions and answer questions. Additional assistance is available via phone, chat or email.

Research and Development

The responsibilities of our research and development organization include product management, product development, quality assurance and technology operations. Our research and development expenses were $11.0 million in 2013, $7.4 million in 2012, and $6.0 million in 2011. Our primary research and development organization is based in Dublin, Ireland, where the first versions of our solutions were developed. We also have research and development operations in Solon, Ohio. Based on feedback from our clients and prospects, we work to develop new functionality while enhancing and maintaining our core offering.

Intellectual Property

Our intellectual property rights are important to our business. We rely on a combination of copyright, trade secret, trademark, patent, and other rights in the United States and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our proprietary technology, processes and other intellectual property. We have a total of twenty-two patents and patents pending in the U.S. and other countries. We have two issued U.S. patents. One relates to vehicle-tracking systems, which expires on December 13, 2026. We also have one Irish patent and one European patent directed toward the same technology. The second U.S. patent concerns systems and methods for identification of frequent stop locations for fleet vehicles using GPS data. This patent expires on April 27, 2032. We have eleven pending U.S. utility patent applications. We also have five international applications filed under the Patent Cooperation Treaty, or PCT, as well as two European patent applications.

In 2011, we filed three U.S. nonprovisional patent applications. Two of these patent applications concern systems and methods for vehicle tracking using GPS data and the other patent application is directed toward providing electronic representations of vehicle routes for a fleet. In 2013, we filed two corresponding European applications based on international applications filed under the PCT directed toward the same technologies.

In 2012, we filed three U.S. nonprovisional patent applications, one of which is now a patent. Two of these patent applications are based on the two U.S. provisional patent applications that we filed in 2011; one relates to systems and methods for tracking and alerting based on GPS vehicle data and the other relates to systems and methods for analyzing vehicle and vehicle fleet performance using GPS data. In 2012, we also filed two corresponding international applications under the PCT directed toward the same technologies. The third U.S. nonprovisional patent application filed in 2012 is now granted as a patent. We also filed a corresponding international application under the PCT in 2013. The patent concerns systems and methods for identification of frequent stop locations for fleet vehicles using GPS data.

In 2013, we filed six U.S. nonprovisional patent applications. Two of the U.S. nonprovisional patent applications are based on a single provisional patent application filed in 2012. Of these two applications, one application is directed toward systems and methods for managing fleet workflow and the other application is directed toward managing driver timekeeping. We also filed two corresponding international applications under the PCT concerning the same technologies in 2013. The other four U.S. nonprovisional patent applications we filed in 2013 are directed toward systems and methods for proprietary fleet management technology.

We also license technology from third parties. We believe our license agreements for third-party software and other intellectual property are generally consistent with industry standard terms and conditions. See Risk FactorsRisks Related to our BusinessWe rely on third-party software and other intellectual property to develop and provide our solutions and significant increases in licensing costs or defects in third-party software could harm our business.

11

Although the protection afforded by copyright, trade secret, trademark and patent law, written agreements and common law may provide some advantages, we believe that the following factors help us to maintain a competitive advantage:

| | the technological skills of our research and development personnel; |

| | frequent enhancements to our solutions; and |

| | continued expansion of our proprietary technology. |

We generally enter into confidentiality and other written agreements with our employees, consultants and partners, and through these and other written agreements, we attempt to control access to and distribution of our software, documentation and other proprietary technology and other information.

We have three registered U.S. trademarks, one registered trademark in the United Kingdom, and one registered trademark in the European Community. These trademarks relate to the Fleetmatics and SageQuest names and logo.

Competition

We compete with point-to-point solution providers as well as other companies with service offerings designed to address similar needs as our solutions. The market for fleet management solutions is highly fragmented. Some of our actual and potential competitors may enjoy competitive advantages over us, such as greater name recognition, longer operating histories, more varied services, and larger marketing budgets, as well as greater financial, technical, and other resources.

We believe that the key competitive factors in the local services and distribution market include:

| | ease of initial setup and use; |

| | product functionality, performance and reliability; |

| | features that best meet the needs of SMB fleet operators; |

| | business intelligence capabilities; |

| | architecture scalability; and |

| | cost. |

We believe that our efficient customer acquisition model, business intelligence approach to fleet management, SaaS delivery model, deep domain expertise and large user base enable us to compete effectively. We believe that many of our competitors rely on up-front hardware sales to finance their operations. Their business models are a significant investment hurdle for SMB customers. Additionally, many of these competitive offerings are difficult to deploy and use and lack other features required by SMB customers.

Some of our competitors have made or may make acquisitions or enter into partnerships or other strategic relationships to offer a more comprehensive service than we do. These combinations may make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology, or service functionality. We expect these trends to continue as companies attempt to strengthen or maintain their market positions.

Employees

As of December 31, 2013, we had 659 full-time employees. None of our employees are represented by a labor union or covered by a collective bargaining agreement.

12

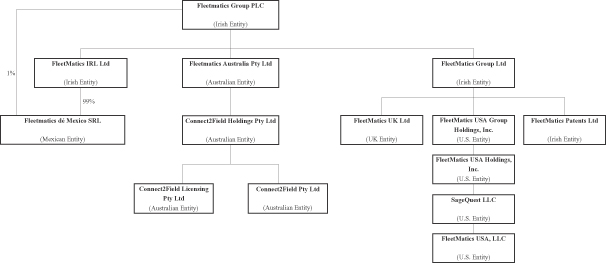

Organizational Structure

We were incorporated in Ireland on October 28, 2004 as a private limited company. Before commencing our initial public offering, a public limited company known as Fleetmatics Group PLC became the holding company of the FleetMatics group by way of a share-for-share exchange in which the shareholders of FleetMatics Group Limited exchanged their shares in FleetMatics Group Limited for identical shares in Fleetmatics Group PLC.

Our registered and principal office is located at Block C, Cookstown Court, Belgard Road, Tallaght, Dublin 24, Ireland. Our U.S. headquarters office is located at 1100 Winter Street, Waltham, Massachusetts and our telephone number is (781) 577-4600. We have additional offices in Rolling Meadows, Illinois, Charlotte, North Carolina, Clearwater, Florida, Tempe, Arizona and Solon, Ohio in the United States, Reading, Berkshire in the United Kingdom, Dublin, Ireland, and in Sydney, Australia.

We are a holding company and conduct substantially all of our business through our wholly-owned operating subsidiaries, FleetMatics IRL Limited, FleetMatics UK Limited, FleetMatics USA, LLC, SageQuest LLC, and Connect2Field Pty Ltd.

We have other non-operating, wholly-owned entities in our group, including FleetMatics Patents Limited, an Irish company, which holds certain group intellectual property.

Additionally, we may, from time to time, incorporate subsidiaries for specific purposes or to carry out particular functions.

The following chart shows our current corporate structure:

Taxation in Ireland

Stamp Duty

Irish stamp duty typically arises on the transfer of shares in an Irish incorporated company.

Shares Held Through DTC

A transfer of our shares effected by means of the transfer of book entry interests in DTC should not be subject to Irish stamp duty.

13

Shares Transferred Into or Out of DTC

A shareholder may transfer our shares into (or out of) DTC without giving rise to Irish stamp duty so long as:

| (a) | there is no change in the ultimate beneficial ownership of the shares as a result of the transfer; and |

| (b) | the transfer into (or out of) DTC is not in contemplation of a sale of the shares by the beneficial owner to a third party. |

Shares Held Outside of DTC

A transfer of our shares where any of the parties to the transfer hold the shares outside of DTC, may be subject to Irish stamp duty (currently at the rate of 1% of the higher of the price paid or the market value of the shares acquired). The transferee of the shares is typically the person that is liable to pay stamp duty.

Due to the potential Irish stamp duty on transfers of our shares, we strongly recommend that shareholders hold their shares through DTC (or through a broker who holds such shares through DTC).

DTC Requirement

In order for DTC, Cede & Co. and National Securities Clearing Corporation, or NSCC, which provides clearing services for securities that are eligible for the depository and book-entry transfer services provided by DTC and registered in the name of Cede & Co., which entities are referred to collectively as the DTC Parties, to agree to provide services with respect to our ordinary shares, the Company has concluded a composition agreement with the Revenue Commissioners of Ireland under which we have assumed any obligation of paying the liability for any Irish stamp duty or similar Irish transfer or documentary tax with respect to our ordinary shares, on (a) transfers to which any of the DTC Parties is a party, or (b) which may be processed through the services of any of the DTC Parties and the DTC Parties have received confirmation from the Revenue Commissioners of Ireland that while such composition agreement remains in force, the DTC Parties shall not be liable for any Irish stamp duty with respect to our ordinary shares.

In addition, to assure the DTC Parties that they will not be liable for any Irish stamp duty or similar Irish transfer or documentary tax with respect to our ordinary shares under any circumstances (including as a result of a change in applicable law), and to make other provisions with respect to our ordinary shares required by the DTC Parties, we and Computershare Trust Company, NA., a U.S. national banking association acting as our transfer agent, or Computershare, entered into a Special Eligibility Agreement for Securities, with DTC, Cede & Co. and NSCC, or the DTC Eligibility Agreement.

The DTC Eligibility Agreement provides for certain indemnities of the DTC Parties by us and Computershare (as to which we have agreed to indemnify Computershare) and also provides that DTC may impose a global lock on our ordinary shares or otherwise limit transactions in the shares, or cause the shares to be withdrawn, and NSCC may, in its sole discretion, exclude our ordinary shares from its Continuous Net Settlement service or any other service, and any of the DTC Parties may take other restrictive measures with respect to our ordinary shares as it may deem necessary and appropriate, without any liability on the part of any of the DTC Parties, (i) at any time that it may appear to any of the DTC Parties, in any such partys sole discretion, that to continue to hold or process transactions in our ordinary shares will give rise to any Irish stamp duty or similar Irish transfer or documentary tax liability with respect to our ordinary shares on the part of any of the DTC Parties or (ii) otherwise as the DTCs rules or the NSCCs rules provide.

Available Information

Our website address is http://www.fleetmatics.com. Information contained in, or accessible through, our website is not a part of this Annual Report on Form 10-K, and the inclusion of our website address in this Annual

14

Report on Form 10-K is an inactive textual reference. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through the investor relations page of our internet website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission. Alternatively, these reports may be accessed at the SECs website at www.sec.gov.

Information about Segment and Geographic Revenue

Information about segment and geographic revenue is set forth in Note 21 of the Notes to Consolidated Financial Statements under Item 8 of this Annual Report on Form 10-K.

| Item 1A. | Risk Factors |

You should carefully consider the following risk factors and all other information contained in this Annual Report on Form 10-K before deciding to invest in our ordinary shares. The risks and uncertainties described below and elsewhere in this Annual Report on Form 10-K, including in the section headed Managements Discussion and Analysis of Financial Condition and Results of Operations, could materially adversely affect our business. Any of the following risks, as well as other risks not currently known to us, could adversely affect our business, financial condition, cash flow and results of operations. In such case, the trading price of our ordinary shares could decline, and you could lose some or all of your investment.

Risks Related to Our Business

Failure to effectively and efficiently attract, sell to and retain SMB customers would adversely affect our operating results.

We primarily market and sell our solutions to SMBs. SMB customers are challenging to reach, acquire and retain in a cost-effective manner. To grow our revenue, we must add new customers, sell additional functionality to existing customers and encourage existing customers to renew their subscriptions. Selling to and retaining SMB customers is more difficult than selling to and retaining enterprise customers because SMB customers generally:

| | have high failure rates; |

| | are price sensitive; |

| | are difficult to reach with targeted sales campaigns; |

| | have high churn rates in part because of the scale of their businesses and the ease of switching services; and |

| | generate less revenue per customer and per transaction. |

If we are unable to market and sell our solutions to SMBs with competitive pricing and in a cost-effective manner, our ability to grow our revenue and maintain and grow our profitability will be harmed.

We may not be able to retain and increase sales to our existing customers, which could negatively impact our financial results.

We generally license our solutions pursuant to customer agreements with an initial term of 36 months. Most agreements provide for renewal automatically for one-year intervals unless the customer elects otherwise, although our customers have no obligation to renew these agreements after their term expires. We also actively seek to sell additional solutions to our existing customers. If our efforts to satisfy our existing customers are not successful, we may not be able to retain them or sell additional functionality to them and, as a result, our revenue and ability to grow would be adversely affected. We track our historical data with respect to customer renewal

15

rates, particularly by measuring the number of new subscriptions added, less the number of subscriptions terminated, divided by the total average customers during a period, which we refer to as net churn. However, we may not be able to accurately predict future trends in customer renewals and the resulting churn. Customers may choose not to renew their subscriptions for many reasons, including the belief that our service is not required for their business needs or is otherwise not cost-effective, a desire to reduce discretionary spending, or a belief that our competitors services provide better value. Additionally, our customers may not renew for reasons entirely out of our control, such as the dissolution of their business, which is particularly common for SMB customers. A significant increase in our churn would have an adverse effect on our business, financial condition, and operating results.

A part of our growth strategy is to sell additional new features to our existing customers. Our ability to sell new features to customers will depend in significant part on our ability to anticipate industry evolution, practices and standards and to continue to enhance existing solutions, such as integration with fuel cards and GPS navigation devices, or introduce or acquire new solutions on a timely basis to keep pace with technological developments both within our industry and in related industries such as our recent acquisition of a field service job management and scheduling application. However, we may prove unsuccessful either in developing new features or in expanding the third-party software and products with which our solutions integrate. In addition, the success of any enhancement or new feature depends on several factors, including the timely completion, introduction and market acceptance of the enhancement or feature. Any new solutions we develop or acquire might not be introduced in a timely or cost-effective manner and might not achieve the broad market acceptance necessary to generate significant revenue. If any of our competitors implements new technologies before we are able to implement them or better anticipates the innovation and integration opportunities in related industries, those competitors may be able to provide more effective or cheaper solutions than ours.

Another part of our growth strategy is to sell additional subscriptions to existing customers as their fleet sizes increase. We cannot be assured that our customers fleet sizes will continue to increase. A significant decrease in our ability to sell existing customers additional functionality or subscriptions would have an adverse effect on our business, financial condition, and operating results.

Adverse economic conditions or reduced spending on information technology solutions, particularly by small and medium-sized local service and distribution businesses, may adversely impact our revenue and profitability.

Uncertainty about future economic conditions makes it difficult for us to forecast operating results and to make decisions about future investments. We are unable to predict the likely duration and severity of the current adverse economic conditions in the U.S. and other countries, particularly in Europe, but the longer the duration, the greater risks we face in operating our business. Furthermore, our solutions are designed predominately for small and medium-sized local service and distribution businesses, which frequently have limited budgets and may be more likely to be significantly affected by economic downturns and other macroeconomic factors affecting spending behavior than larger enterprises. SMB customers may choose to spend the limited funds that they have on items other than our solutions and may experience higher failure and bankruptcy rates, which would negatively affect the overall demand for our products, increase customer attrition and could cause our revenue to decline. We cannot assure you that current economic conditions, worsening economic conditions or prolonged poor economic conditions will not have a significant adverse impact on the demand for our solutions, and consequently on our results of operations and prospects.

Failure of local service and distribution businesses to adopt fleet management solutions could negatively impact our revenue.

We derive, and expect to continue to derive, substantially all of our revenue from the sale of subscriptions to our fleet management solutions. As a result, widespread acceptance and use of fleet management solutions is critical to our future revenue growth and success. If the market for fleet management solutions fails to grow or grows more slowly than we currently anticipate, demand for our solutions could be negatively affected.

16

Changes in customer preferences for fleet management solutions may have a disproportionately greater impact on us than if we offered multiple products and services. The market for fleet management solutions is subject to changing customer demand and trends in preferences. Some of the potential factors that could affect interest in and demand for our fleet management solutions include:

| | awareness of our brand and fleet management solutions generally; |

| | the reliability of our solutions; |

| | actual and perceived fuel and vehicle maintenance costs, including decreases in fuel prices; |

| | assumptions regarding general mobile workforce inefficiency; |

| | the price, performance, features, and availability of products and services that compete with ours; |

| | our ability to maintain high levels of customer satisfaction; and |

| | the rate of growth in online solutions generally. |

Our dependence on various lead generation programs could adversely affect our operating results if we need to pay more for such programs or we are unable to attract new customers at the same rate.

We use a number of lead generation programs to promote our solutions. Significant increases in the pricing of one or more of our lead generation channels would increase our overall lead generation costs or cause us to choose less expensive and perhaps less effective channels. For example, a portion of our potential customers locate our website through search engines, such as Google, Bing, and Yahoo!, representing one of the most efficient means for generating cost-effective SMB customer leads. If search engine companies modify their search algorithms in a manner that reduces the prominence of our listing, or if our competitors search engine optimization efforts are more successful than ours, fewer potential customers may click through to our website. In addition, the cost of purchased listings has increased in the past and may continue to increase in the future. As we add to or change the mix of our lead generation strategies, we may need to expand further into channels with significantly higher costs than our current programs, which could adversely affect our operating results. If we are unable to maintain effective advertising programs, our ability to attract new customers could be adversely affected, our advertising and marketing expenses could increase substantially, and our operating results may suffer.

If we are unable to successfully convert customer sales leads into customers on a cost-effective basis, our revenue and operating results would be adversely affected.

We generate substantially all of our revenue from the sale of subscriptions to our solutions. In order to grow, we must continue to efficiently convert customer leads, many of whom have not previously used fleet management solutions, into customers. Our Web-based sales team is the primary driver of cost-effective conversion of customer leads into customers, particularly in the case of SMB customers who are more difficult to reach with targeted sales campaigns and who tend to generate less revenue per transaction. Our Web-based sales team is able to sell our solutions to the geographically-disparate SMB market much more efficiently than a traditional field-based direct sales force. To execute our growth plan, we must continue to attract and retain highly qualified Web-based sales personnel. We may experience difficulty in hiring and retaining highly skilled Web-based sales and marketing employees. An inability to convert customer sales leads into customers on a cost-effective basis could adversely affect our revenue and operating results.

Our quarterly operating results have fluctuated in the past and may fluctuate in the future, which could cause declines or volatility in the price of our ordinary shares.

Our quarterly operating results have fluctuated in the past and may fluctuate in the future as a result of a variety of factors, many of which are outside of our control. If our quarterly operating results or guidance fall below the expectations of research analysts or investors, the price of our ordinary shares could decline substantially. The following factors, among others, could cause fluctuations in our quarterly operating results:

| | our ability to attract new customers and retain existing customers; |

17

| | our ability to accurately forecast revenue and appropriately plan our expenses; |

| | our ability to introduce new features, including integration of our existing solutions with third-party software and devices; |

| | the actions of our competitors, including consolidation within the industry, pricing changes or the introduction of new services; |

| | our ability to effectively manage our growth; |

| | our ability to successfully manage any future acquisitions of businesses, solutions, or technologies; |

| | our ability to successfully sell into additional geographies utilizing our current lead generation and sales model; |

| | the timing and cost of developing or acquiring technologies, services, or businesses; |

| | the timing, operating costs, and capital expenditures related to the operation, maintenance, and expansion of our business; |

| | service outages or security breaches and any related occurrences which could impact our reputation; |

| | the impact of worldwide economic, industry, and market conditions, including disruptions in financial markets and the deterioration of the underlying economic conditions in some countries, and those conditions specific to Internet usage and online businesses; |

| | trade protection measures (such as tariffs and duties) and import or export licensing requirements; |

| | fluctuations in currency exchange rates; |

| | costs associated with defending intellectual property infringement and other claims; and |

| | changes in government regulation affecting our business. |

We believe that our quarterly revenue and operating results may vary significantly in the future and that period-to-period comparisons of our operating results may not be meaningful. You should not rely on the results of one quarter as an indication of future performance.

We have previously identified material weaknesses in our internal control over financial reporting, some of which had resulted in a restatement of certain statements of cash flows. While we have remediated these material weaknesses, we may identify additional material weaknesses in the future that may cause us to fail to meet our reporting obligations or result in material misstatements of our financial statements.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with U.S. generally accepted accounting principles. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

Prior to the completion of our October 2012 initial public offering, we had been a private company with limited accounting personnel and other resources to address our internal control over financial reporting. During the course of preparing for our October 2012 initial public offering, our independent registered public accounting firm undertook audits of our financial statements for the years ended December 31, 2010 and December 31, 2011, which were completed simultaneously. During the course of these audits, material adjustments to various accounts were necessary. These adjustments led our independent registered public accounting firm to communicate that we had material weaknesses as of December 31, 2010 and December 31, 2011. In addition, there were certain errors we identified in late 2012 in our consolidated statements of cash flows for the periods ended June 30, 2011 and 2012

18

and September 30, 2011 and 2012 which caused us to restate the consolidated statements of cash flows for these periods. As of December 31, 2012, the Company had remediated two previously determined material weaknesses, but it was determined that the following two material weaknesses remained:

| | we did not have sufficient formalized policies and procedures to ensure that complete and accurate, consolidated financial information was prepared and reviewed timely in accordance with U.S. GAAP; and |

| | we lacked sufficient and timely formalized monthly, quarterly and annual financial data reviews and analysis. |

During the year ended December 31, 2013, we undertook efforts to remediate these remaining material weaknesses. Our efforts consisted of the following:

| | Implementation of Formalized Policies and Procedures We have implemented a more structured monthly and quarterly close process to improve the completeness, timeliness and accuracy of our financial reporting and disclosures including, but not limited to, those regarding proper financial statement classification, share-based compensation, and recognition of accruals. We have formalized and documented our consolidation and financial reporting policies and procedures as well as created a uniform set of standards and guidelines for our finance and accounting personnel across all of our subsidiaries, as well as at the consolidated level, and have added personnel with the appropriate experience to facilitate these processes. This approach has led to a more streamlined and consistent reporting process across all of our subsidiaries, as well as at the consolidated level, for both quarterly and year-end reporting. Further, we have formalized the development of policies and procedures memoranda across key accounting areas. This has enabled financial personnel to obtain information on our most important processes quickly and accurately, assisting in the overall result of consistency across all subsidiaries. Finally, we have begun the process of implementing additional functionality with our upgraded accounting system that will further enhance our ability to maintain the improved financial close process across all subsidiaries of the Company, as well as the consolidated level. Furthermore, our upgraded accounting system will enable consistent financial reporting across all subsidiaries as the business continues to grow. |

| | Implementation of Financial Data Reviews As a result of the additional employees added to the finance function, as well as the implementation of certain functionality of our upgraded general ledger system, we are able to process period end financial information on a more timely and predictable timeline. This has allowed for greater lead times between consolidation and reporting of financial information, which has provided, and will continue to provide, additional time for the review and analysis of monthly, quarterly and annual financial data and information. Further, as our improved processing of information has been in place for a period of time as of December 31, 2013, we have accumulated an ample quantity of cycles whereby such processing was in place, providing support for our conclusion that the controls noted herein were operating effectively as of December 31, 2013. |

While our remediation efforts on the previously identified material weaknesses are complete, we continue to ensure that such controls are operating effectively, and in those efforts are supported by confirmation and testing by management, as well as the active oversight of the Audit Committee. While we feel that we have remediated the remaining two material weaknesses noted above, and that the related controls are operating effectively, we continue to seek improvements to enhance our control environment, and to identify other potential areas of improvements of the design of the controls already in place. The identification of additional material weaknesses in the future, could adversely affect our ability to report financial information, including our filing of quarterly or annual reports with the SEC on a timely and accurate basis.

We are migrating to a new accounting system and, if this new system proves ineffective, we may be unable to timely or accurately prepare financial reports.

We are in the process of upgrading our accounting systems to provide us with the necessary accounting controls needed for our financial reporting requirements as a public company. Any problems or delays associated

19

with the implementation of our new and enhanced accounting platform or the failure to complete such implementation on a timely basis could adversely affect our ability to report financial information as our company grows, including the filing of our quarterly or annual reports with the SEC on a timely and accurate basis. After converting from prior systems and processes, we may discover data integrity problems or other issues that, if not corrected, could impact our business or financial results.

We have an accumulated deficit and may not be able to sustain profitability, which may negatively impact our ability to achieve our business objectives.

We reported net income of $30.5 million for 2013, $5.4 million for 2012, and $2.9 million for 2011. We cannot predict if we will be able to sustain profitability. We expect to continue making significant expenditures to develop and expand our business. In addition, as a public company, we will continue to incur additional significant accounting, legal and other expenses that we did not incur as a private company. These increased expenditures make it harder for us to sustain profitability. The recent growth in our revenue and customer base may not be sustainable, and we may not generate sufficient revenue to sustain profitability. We may incur significant losses in the future for a number of reasons, including the other risks described in this section, and we may encounter unforeseen expenses, difficulties, complications and delays and other unknown events. Accordingly, we may not be able to sustain profitability and the failure to fund our capital requirements may negatively impact our ability to achieve our business objectives.

The market in which we participate is highly fragmented and competitive, with low barriers to entry. If we do not compete effectively, our operating results may be harmed.

The market for fleet management solutions is highly fragmented, consisting of a significant number of vendors, competitive and rapidly changing, with relatively low barriers to entry. Competition in our market is based primarily on the level of difficulty in installing, using and maintaining solutions, total cost of ownership, product performance, functionality, interoperability, brand and reputation, distribution channels, industries and the financial resources of the vendor. We expect competition to intensify in the future with the introduction of new technologies and market entrants. Mobile service and software providers, such as Google and makers of GPS navigation devices, such as Garmin, provide limited services at lower prices or no charge, such as basic GPS-based mapping, tracking and turn-by-turn directions that could be expanded or further developed to more directly compete with our solutions. We primarily compete with Teletrac, a Trafficmaster Plc Company, and Trimble Navigation Limited, and, to a lesser extent, other companies. Competition could result in reduced operating margins, increased sales and marketing expenses and the loss of market share, any of which would likely cause serious harm to our operating results.

Industry consolidation may result in increased competition, which could result in a loss of customers or a reduction in revenue.

Some of our competitors have made or may make acquisitions or may enter into partnerships or other strategic relationships to offer more comprehensive services than they individually had offered or achieve greater economies of scale. In addition, new entrants not currently considered to be competitors may enter our market through acquisitions, partnerships or strategic relationships. For example, CalAmp Corp., our primary supplier of in-vehicle devices, previously announced the acquisition of Wireless Matrix Corporation, which offers fleet management applications and FleetCor, one of our fuel card providers, who recently acquired NexTraq, which offers fleet management applications. We expect these trends to continue as companies attempt to strengthen or maintain their market positions. Many of the potential entrants, particularly those providing enterprise-level solutions and those who historically focused on the long-haul industry, may have competitive advantages over us, such as greater name recognition, longer operating histories, more varied services and larger marketing budgets, as well as greater financial, technical and other resources. The companies resulting from combinations or that expand or vertically integrate their business to include the SMB market that we address may create more compelling service offerings and may offer greater pricing flexibility than we can or may engage in business

20

practices that make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology or service functionality. These pressures could result in a substantial loss of our customers or a reduction in our revenue.

Our inability to adapt to rapid technological change in our industry and related industries could impair our ability to remain competitive and adversely affect our results of operations.

The industry in which we compete and related industries are characterized by rapid technological change, frequent introductions of new products and evolving industry standards. In addition to the fleet management solutions industry, we are subject to changes in the automotive, mobile handset, GPS navigation device and work flow software industries. As the technology used in each of these industries evolves, we will face new integration and competition challenges. For example, as automobile manufacturers evolve in-vehicle technology, GPS tracking devices may become standard equipment and compete against our solutions. Furthermore, major gains in fuel efficiency may lead to a relative decrease in the demonstrable return on investment of our solutions perceived by our customers. If we are unable to adapt to rapid technological change, it could adversely affect our results of operations and our ability to remain competitive.

An assertion by a third party that we are infringing its intellectual property could subject us to costly and time-consuming litigation or expensive licenses and our business could be harmed.

The fleet management and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. Much of this litigation involves patent holding companies or other adverse patent owners who have no relevant product revenues of their own, and against whom our own patent portfolio may provide little or no deterrence.